Pre-market trading in US stocks | Li Auto plunges 7%, Tesla drops over 2%! Cryptocurrency concept stocks soar!

理想汽车盘前跌超 7%,小鹏跌近 4%,蔚来跌超 1%,哔哩哔哩涨超 2%,阿里、京东涨超 1%;特斯拉跌超 2%,英伟达涨近 3%,AMD、Meta 涨超 1%;Riot Platform 涨近 6%,Microstrategy、Marathon Digital 涨近 5%。

美股要闻

1、中国外交部发言人汪文斌宣布:应中共中央政治局委员、外交部长王毅邀请,美国国务卿安东尼·布林肯将于 4 月 24 日至 26 日访华。

2、纽交所就全天交易向市场参与者进行调查。

3、理想全面调整价格体系:L 系列降幅 1.8 万-2 万元,MEGA 降幅 3 万元

4、台积电宣布,今年 4 月年度平均调薪 3%-5%,与去年调薪幅度相同。个人调薪幅度则视个人绩效、年资、职等许多条件而定。

5、4 月 22 日,针对网传盒马创始人侯毅(花名:老菜)和阿里巴巴前 CEO 张勇有意联合竞购盒马,出价 20 亿美元一事,盒马回应称,该消息不实。

6、特斯拉迎来中国首批 Model S 交付十周年。数据显示,2014 年至今,特斯拉中国车主数量从 15 位增长到 170 多万。

7、小鹏汽车官方微博:小鹏 G6 作为品牌首款兼顾左右舵驾驶的全球车型,继港澳、新马泰亮相后,很快也将要在欧洲开售了。

8、软银将斥资 9.6 亿美元增强人工智能算力。

9、黄仁勋表示,人形机器人在不久的将来有望成为大众化设备,售价或不会超过 1 万-2 万美元。

10、据知名科技记者 Mark Gurman 称,人们对 Vision Pro 的兴趣逐渐减弱,消费者对其演示的需求大幅下降,很多地区的销售量已经从每天几台变成了一周几台。

他还表示,苹果公司正在研发一种运行于设备端的大型语言模型(LLM),该模型将优先保证响应速度和隐私保护能力。

11、腾讯宣布,2024 年 5 月 21 日《地下城与勇士:起源》(《DNF 手游》)将正式上线。

盘前异动

美股盘前,三大股指期货上涨,恐慌指数下跌。

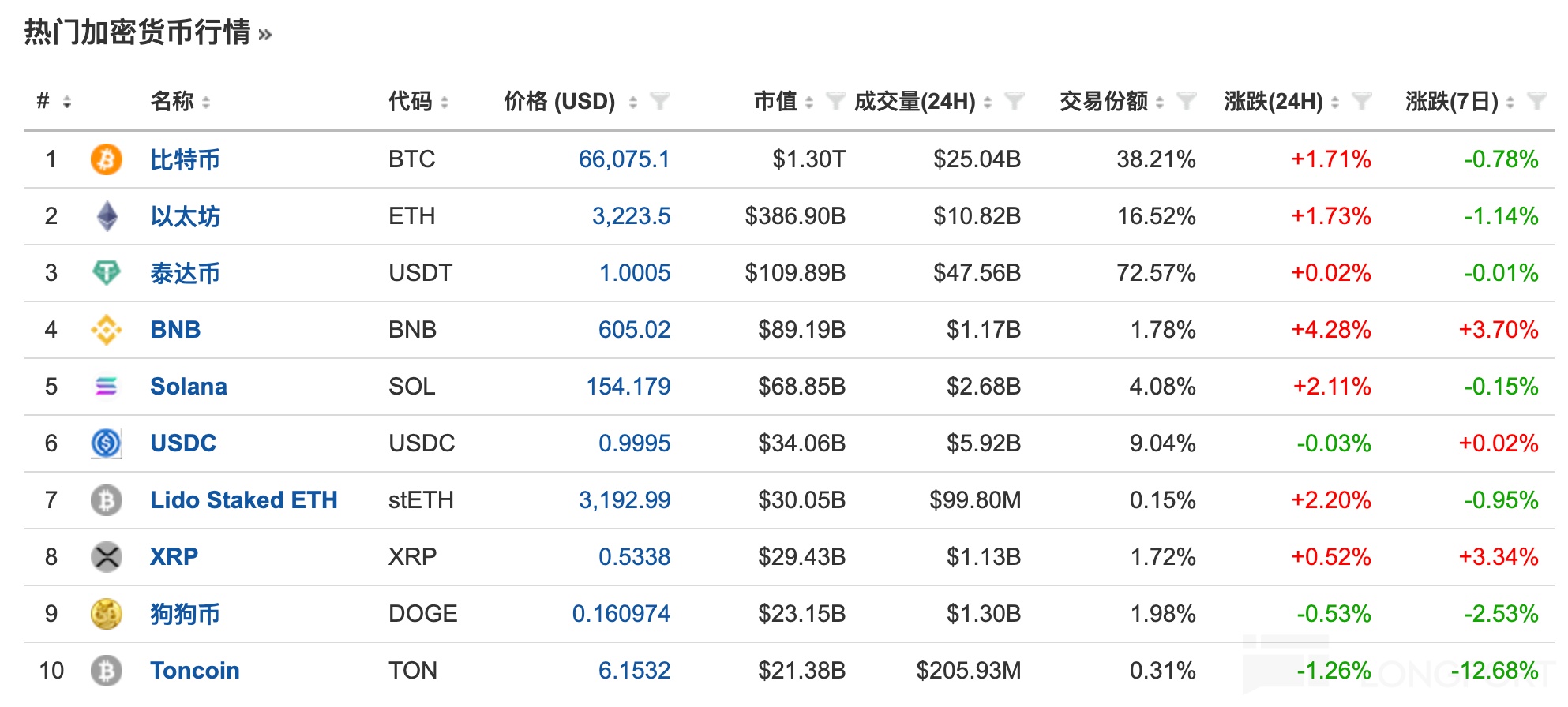

比特币现报 66075 美元,24 小时涨近 2%;以太坊现报 3223 美元,24 小时涨近 2%。

加密货币概念股大涨,科技股、中概股涨跌不一。

Riot Platform 涨近 6%,Microstrategy、Marathon Digital 涨近 5%,Hut 8 涨近 4%,Coinbase 涨 3%。

特斯拉跌超 2%,英伟达涨近 3%,AMD、Meta 涨超 1%。

中概股方面,理想汽车跌超 7%,小鹏跌近 4%,蔚来跌超 1%,哔哩哔哩涨超 2%,阿里、京东涨超 1%,拼多多、百度涨近 1%。

策略回顾

1、该抄底美股了?当前仍有风险!

研究显示,标普 500 指数在第一季度每上涨 10% 或以上,就会出现 11% 的平均最大跌幅。不过,自 1950 年以来,在 11 次此类事件中,该指数有 10 次当年最终收涨。如果标普 500 指数在未来几周再跌 2% 至 4914 点附近,CTA 可能会卖出约 310 亿美元的股票。

2、美股 AI 板块暴跌:盈利将受考验,关注宏观不确定性

5 月 1 日的美联储议息会议将是市场观测的窗口,6 月份 FOMC 的降息概率会对未来美股表现产生影响。近期 AI 相关股票下跌,显示分子端支撑出现崩塌。本周特斯拉、微软、META 和 Alphabet 将公布财报,形成市场压力测试。降息会成为未来一段时间内的博弈焦点,纽约联储公布的隔夜逆回购存量下降,引发市场流动性担忧。

3、本周会挽救美股吗?美联储 “最爱” 通胀指标、科技巨头财报来袭

本周,经济增长和通胀的关键数据,以及特斯拉、Meta、微软、谷歌母公司 Alphabet 业绩的公布,将决定美股的萎靡是否会持续下去!