US Stock Options | Tesla, Apple lead the way, Coin, AMC, DJT all see a surge in trading volume!

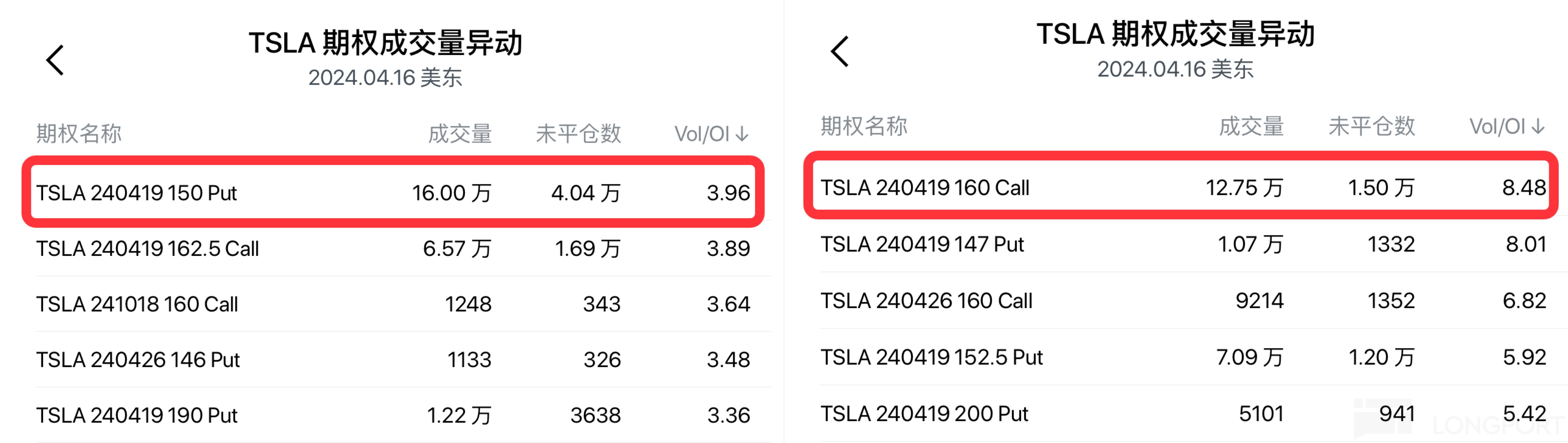

隔夜最火:4 月 19 日到期、执行价 150 美元和 155 美元的特斯拉 put 均成交 16 万张左右。WBD 期权成交暴涨至 30 万张,5 月 31 日到期、执行价 8 美元的看跌期权成交 12.5 万张。特朗普概念股 DJT 期权成交暴涨至 22 万张,看跌期权占比 65.4%。

隔夜,美股科技股涨跌不一,但特斯拉、亚马逊等多股连跌三日,中概股总体继续下跌。

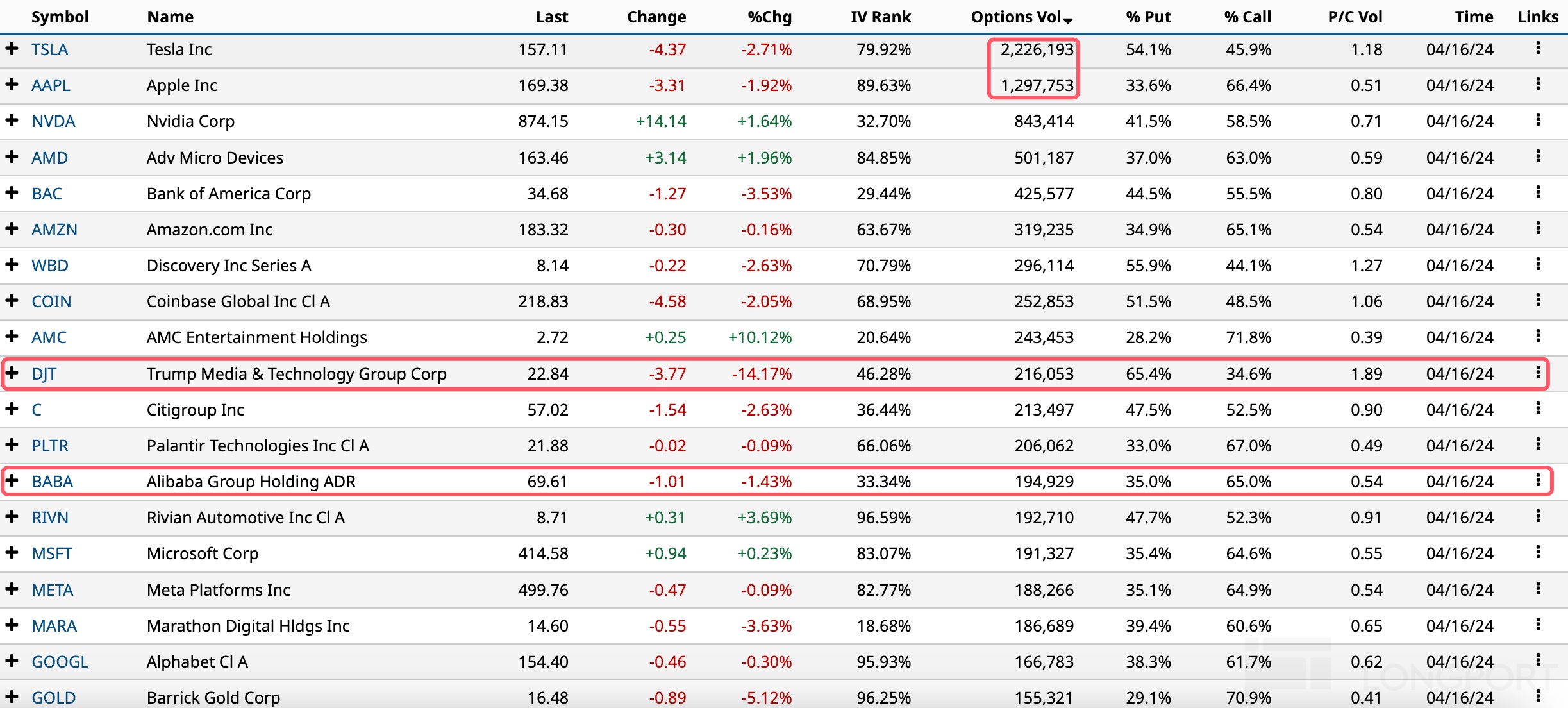

美股期权成交概览

隔夜前十大美股期权成交:特斯拉、苹果、英伟达、AMD、美国银行、亚马逊、WBD、Coinbase、AMC 电影院线、DJT。

其中:

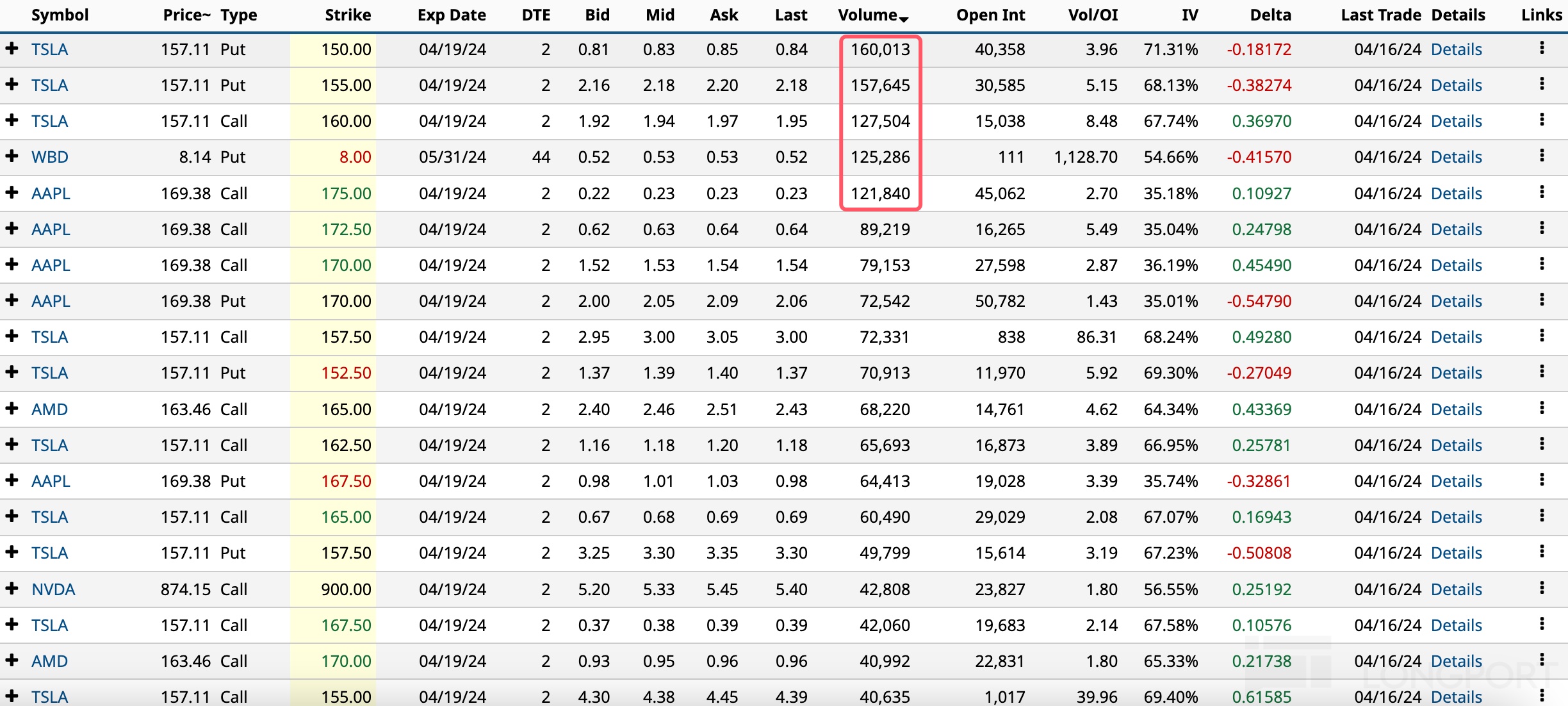

特斯拉跌近 3%,期权成交涨至 223 万张,看跌期权占比 54%。4 月 19 日到期、执行价 150 美元和 155 美元的看跌期权均成交 16 万张左右,执行价 160 美元的看涨期权成交 13 万张。

苹果跌 2%,期权成交涨至 130 万张,看涨期权占比 66.4%。执行价 175 美元的看涨期权成交 12 万张,执行价 172.5 美元和 170 美元的看涨期权也分别成交 9 万张和 8 万张。

英伟达涨近 2%,期权成交跌至 84 万张,看涨期权占比 58.5%。执行价 900 美元的看涨期权成交超 4 万张。

AMD 涨 2%,期权成交跌至 50 万张,看涨期权占比 63%。执行价 165 美元的看涨期权成交 7 万张。

美国银行跌超 3%,期权成交大涨至 42.5 万张,看涨期权占比 55.5%。

亚马逊微跌,期权成交跌至 32 万张,看涨期权占比 65%。

WBD(华纳兄弟探索)跌近 3%,期权成交暴涨至 30 万张,看跌期权占比 56%。5 月 31 日到期、执行价 8 美元的看跌期权成交 12.5 万张。

Coinbase 跌 2%,期权成交大涨至 25 万张,看跌期权占比 51.5%。

AMC 电影院线大涨 10%,期权成交大涨至 24 万张,看涨期权占比 72%。

特朗普概念股 DJT 跌超 14%,期权成交暴涨至 22 万张,看跌期权占比 65.4%。

阿里跌超 1%,期权成交涨至 19 万张,看涨期权占比 65%。