Bank of America: Don't just focus on NVIDIA when it comes to chip stocks, there are three other companies worth considering as well

美银将迈威尔科技、美光科技和 AMD 并称为 AI 芯片领域的 “新晋三武士”,称其有望占据 “有利可图的细分市场”。

本文作者:李笑寅

本文来源:硬 AI

AI 芯片新秀正在后来居上。

美国银行分析师 Vivek Arya 在最新的报告中指出,尽管目前英伟达和博通是 AI 芯片领域的两大 “领头羊”,但迈威尔科技(股票代码:MRVL)、美光科技(股票代码:MU)和 AMD(股票代码:AMD)这三家公司在该领域也极具潜力,有望占据 “有利可图的细分市场”。

Arya 将这三家公司并称为 AI 芯片领域的 “新晋三武士”,均给予了 “买入” 评级。

报告称,迈威尔科技在电光和专用集成电路 (ASIC) 领域拥有引人注目的机会。此前,迈威尔科技曾表示公司有潜力赢得超过 10% 的定制 AI 芯片市场份额,并在电光产品市场占据主导地位。

Arya 认为,迈威尔科技在 AI 网络芯片领域仅次于博通,位居第二,预计 4 月 11 日的行业分析日将会给该公司带来一波股价上涨。不过由于公司的业绩 “过去几个季度一直不稳定”,预计迈威尔科技的传统业务在短期内可能陷入低迷。

美光科技则因其在高带宽存储产品(HBM)方面的前景而受到 Arya 的青睐。Arya 表示,随着边缘 AI 的兴起和发展,美光科技有望成为赢家。

Arya 在报告中表示:

“HBM 可能是第一个迅速蚕食供应的内存技术,因其消耗的晶圆数量是传统 DRAM 内存的三倍。”

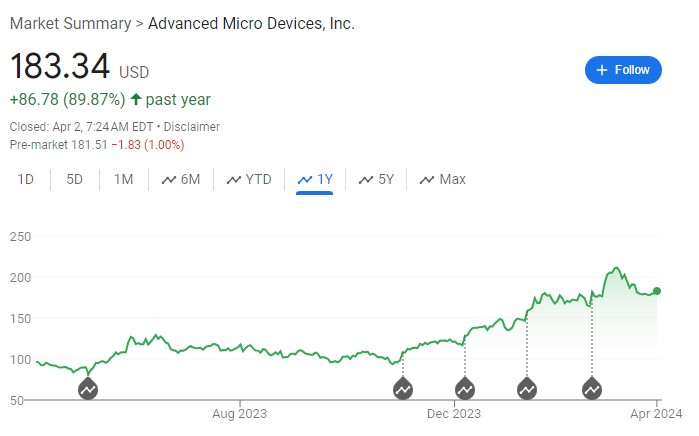

对于 AMD,Arya 不像普遍预期那样认为该公司将在 AI 服务器市场上占据 20% 的份额,但他仍然看好 AMD 在芯片市场的前景。

Arya 指出,凭借在 AI 市场的快速崛起和公司一贯的执行能力,AMD 有望在 AI 加速器市场上持有 5-10% 的份额。

虽然报告对 “新晋三武士” 均持乐观态度,但同时也警告称,三者的股价相对于各自领域的 “领头羊” 存在估值溢价,未来可能会出现较大的股价波动。