US Stock Options | Tesla, Nvidia collectively fall in trading! Alibaba, Micron Technology trading surges!

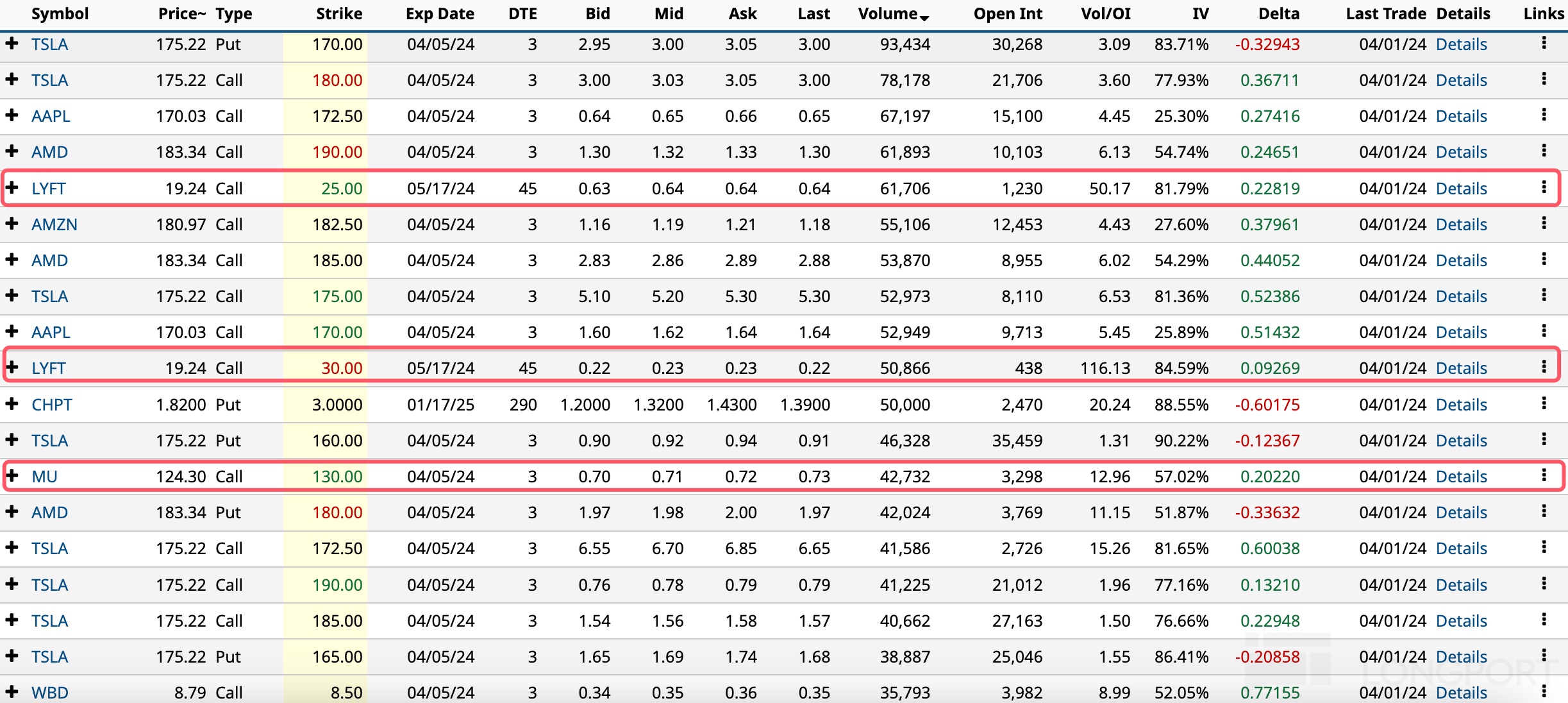

隔夜最火合约:4 月 5 日到期、执行价 170 美元的特斯拉 put,成交超 9 万张。美光科技期权成交翻倍至 51 万张,看涨期权占比 68%。阿里期权成交大涨至 15 万张,看涨期权占比 79.5%。

隔夜,中概股整体走高,AI 股下跌,美股七巨头涨跌不一。

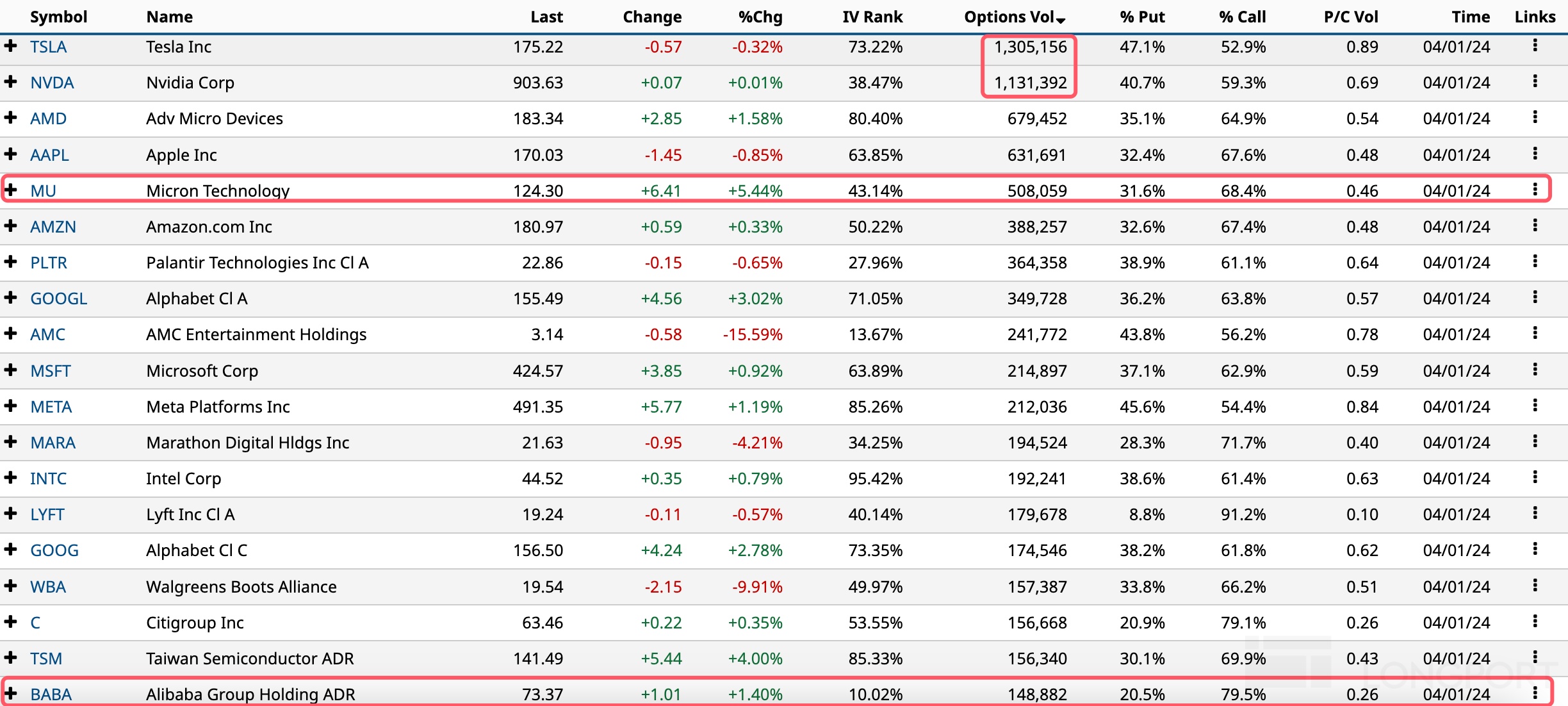

美股期权成交概览

隔夜前十大美股期权成交:特斯拉、英伟达、AMD、苹果、美光科技、亚马逊、Palantir、谷歌 A、AMC 电影院线、微软。

其中:

特斯拉微跌,期权成交回落至 130 万张,看涨期权占比 53%。4 月 5 日到期、执行价 170 美元的看跌期权成交超 9 万张,执行价 180 美元的看涨期权成交近 8 万张。

英伟达微涨,期权成交回落至 113 万张,看涨期权占比 59%。

AMD 涨超 1%,期权成交回落至 68 万张,看涨期权占比 65%。执行价 190 美元的看涨期权成交超 6 万张。

苹果跌近 1%,期权成交回落至 63 万张,看涨期权占比 67.6%。执行价 172.5 美元的看涨期权成交近 7 万张。

美光科技涨超 5%,期权成交翻倍至 51 万张,看涨期权占比 68%。执行价 130 美元的看涨期权成交超 4 万张。

亚马逊微涨,期权成交回落至 39 万张,看涨期权占比 67.4%。执行价 182.5 美元的看涨期权成交超 5 万张。

Palantir、谷歌 A 期权成交均超 35 万张,均以看涨期权为主。

AMC 电影院线大跌超 15%,期权成交微跌至 24 万张,看涨期权占比 56%。

台积电涨 4%,期权成交大涨至 15 万张,看涨期权占比 70%。

阿里涨超 1%,期权成交大涨至 15 万张,看涨期权占比 79.5%。

Lyft 期权异动,5 月 17 日到期、执行价 25 美元的看涨期权成交超 6 万张;执行价 30 美元的看涨期权成交 5 万张。