Barclays: Just "talking the talk" is not enough, the Bank of Japan may raise interest rates in July

日本央行加息可能比想象中来得更快?

日元持续走软、经济复苏稳健、涨薪前景乐观……日本央行加息可能比想象中来得更快?

巴克莱银行于 3 月 29 日发布研报称,仅仅通过 “口头” 影响市场对政策利率的定价对日央行来说 “相当具有挑战性”,因此继续预计日本央行将在七月加息至 0.25%、可能在 2025 年 4 月再次加息,并将对末端利率(最终利率水平)的预期上调至 0.5%。

在近期不会再次加息的市场普遍预期下,巴克莱此番预测显得十分激进。

巴克莱称,鉴于日元持续疲软、油价走高和工资增长处于 “支持/不支持加息” 的临界点,预计日央行加息路径的风险偏向上行,如果前述情形强于预期,日央行还可能会提前第三次加息的时点。

日元持续疲软 亟需政府干预

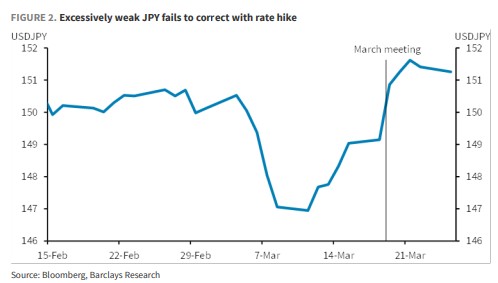

巴克莱表示,日元过度疲软的态势将持续成为日央行关注的焦点。自日央行在 3 月利率会议上宣布加息以来,日元已持续贬值至 34 年低点。

华尔街见闻此前提及,美元兑日元一路飙升至 151 上方,距离上次日本直接干预汇市时的汇率水平(151.97)仅 “一步之遥”,另外,日本外汇最高主管也在一周内连续两次口头干预,加剧了日本当局采取汇市干预行动的风险。

3 月 22 日,日本财务大臣铃木俊一也进行了口头干预,警告称当局正在 "以高度的紧迫感 "关注利率。

日本央行行长植田和男此前曾表示:

“如果汇率对日本央行的经济活动和价格前景有重大影响,日本央行自然会考虑采取货币政策应对措施。有鉴于此,我们将考虑美日政策利率前景与美元兑日元之间的关系,以及美元兑日元与通胀之间的关系。”

巴克莱认为,如果美国方面没有出现利率水平的大幅下调,日央行在不久的将来就会需要加息来修正日元的持续疲软。

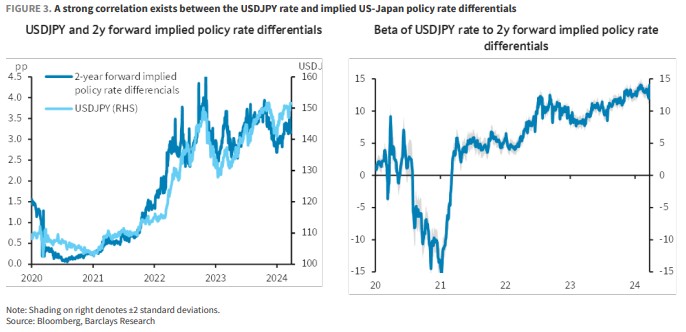

我们构建了一个美元兑日元利率对隐含利差敏感度的理论模型,显示隐含利差每变动 0.1 个百分点,美元兑日元水平就会波动 1.4 日元。根据模型进行估算,可以发现:

- 假定美国政策利率的定价保持不变,如果市场对日本政策利率的定价从目前的约 0.5% 水平上升 0.5 个百分点,美元兑日元可能会从目前的即期汇率(截至 3 月 25 日为 151.3)下跌约 5%。

而显然,日央行如果仅仅是通过 “嘴炮”,是不能带来如此大规模的定价变动的。

- 如果美国政策利率定价上调 0.5 个百分点,在日本方面没有变化的情况下,美元兑日元可能会进一步攀升 5%。

同时,模型显示敏感度正在稳步上升——表明市场对美日两个经济体货币政策的关注度越来越高。

多因素助推通胀走高 放大加息可能性

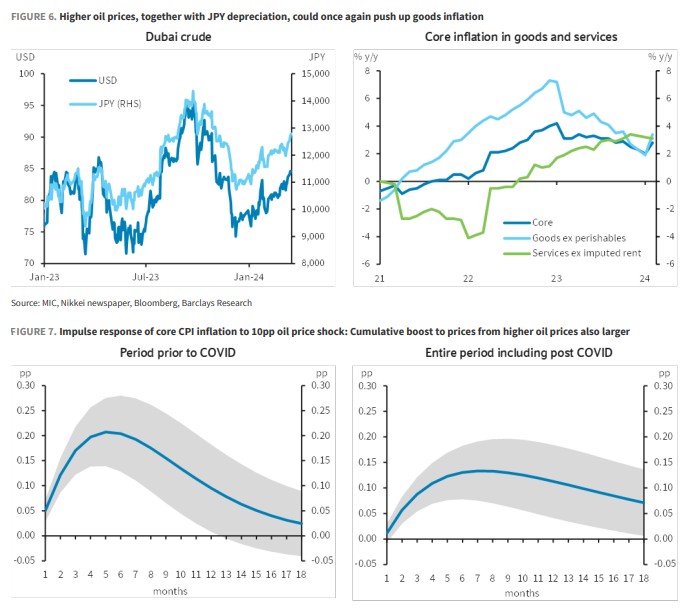

巴克莱表示,由于近期日元贬值和油价走高,商品通胀上行的可能性正在增加。

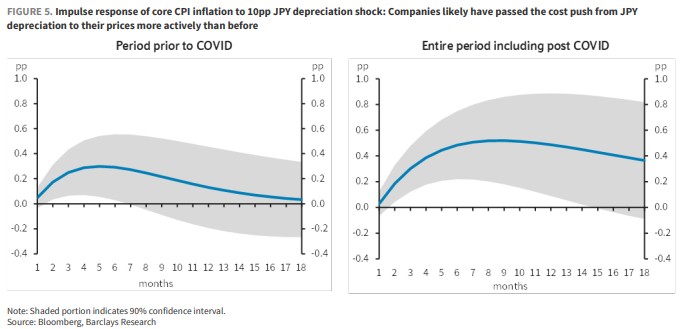

报告显示,美元兑日元汇率对核心 CPI 的影响在新冠疫情后变得更显著,意味着日本企业疫情后更积极地将日元贬值的成本转嫁到了产品价格上。

在新冠疫情之前,10% 的日元贬值对核心 CPI 通胀的影响在 5 个月后达到约 0.3% 的峰值,在 6 个月后统计意义上的影响消失。

然而,在新冠疫情之后,这种影响在八个月后达到峰值,约为 0.5%,并且在统计意义上的显著影响持续了一年多。

其次,最近有所上涨的油价,对于通胀走高的助推力也越来越大。

据上述模型,估算迪拜原油价格(以美元计)上涨 10% 对核心 CPI 通胀的影响路径。结果显示,自新冠疫情以来,累积影响已经上升。

更具体地说,虽然峰值影响从新冠疫情之前的 0.2% 下降到疫情后的 0.13%,但统计显著性周期从 12 个月大幅延长到 18 个月左右,导致后者的累积影响达到原先的约 1.2 倍,这又进一步放大了日元贬值的风险。

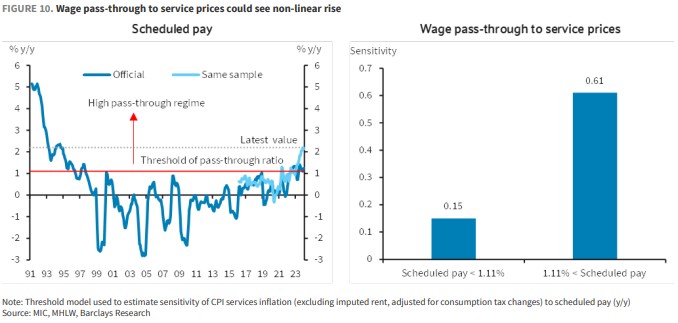

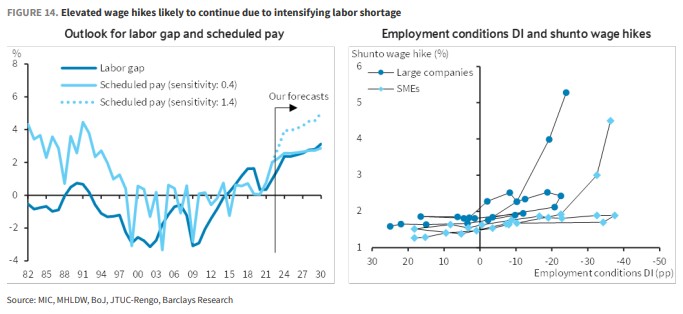

此外,在日央行长期关注的工资/通胀循环方面,巴克莱预计今年的最终工资增幅将达到 4.6%,并还有上行可能,当整体名义工资涨幅超过 1.11% 的临界点,服务通胀将会出现非线性上升(上升幅度会更大)。

预计从 4 月到 7 月左右,工资将按计划上调。随着成本推动型通胀也呈放缓趋势,我们认为实际工资增长转为正值的可能性越来越大。

名义工资在截至 2024 年 1 月的过去半年中呈现 2% 的稳健增长,再加上今年工资的大幅上涨,预计实际工资在 6 月前后小幅回升的可能性增大,已经稳定在 3% 左右的服务通胀可能会进一步上升。

最后,报告还提到了另一个评估经济活动和通胀的重点:产出缺口。

目前,日央行预估的产出缺口仍略微处于负值,即因需求疲弱而导致限制产能。巴克莱预计,如果实际工资增长从年中开始转正,那么消费有望复苏,产出缺口有望在年中同步转为正值。

尽管将该指标作为工资和通胀压力的先行指标的有效性仍受质疑,但报告认为届时应关注央行在这方面的沟通,或将增加通胀上行的可能。

7 月加息后 再次加息的空间有限

报告同样表示,一旦利率上调至 0.25%,进一步加息的障碍可能会大大增加,因为这将首次对经济产生明显影响,需要考虑可能带来的政治影响。

因此,巴克莱预计,日央行在 7 月加息后将保持较长时间的观望态度,不过 2024 年的下议院大选和 11 月的美国大选会构成风险因素。

总体而言,巴克莱基于对经济活动、价格和金融状况的考量,预测偏向于提前加息。

如果日元持续过度疲软,且通胀因前述因素而继续强于预期,巴克莱认为日央行在 7 月会议上加息后,可能会在 10 月或明年 1 月的议息会议上再次考虑加息。

我们认为,基于今年通胀和盈利增长下降的前景,2025 财年的工资涨幅可能会小于 2024 财年(今年 4 月 1 日至明年 3 月 1 日)。

尽管如此,日本似乎已经到了第二个刘易斯拐点(劳动力由过剩向短缺的转折点),劳动力短缺问题日益突出,这已经导致日本企业的涨薪心态发生了重大变化。因此,即使 2025 财年的工资涨幅小于 2024 财年,我们仍认为其涨幅可能大于 2023 财年,并连续第三年保持高位。