Bank of Communications Annual Report Released: Dividend payout ratio has exceeded 30% for 12 consecutive years, net profit growth, and non-performing loan ratio decreased

交通银行发布 2023 年年报,显示净利润增长、不良率下降,分红率连续 12 年超过 30%。汇丰银行意外增持交通银行。年报显示,交通银行利润增长主要来源于非利息净收入的增加和信用减值损失的减少。利息净收入下降主要是受贷款市场报价利率和客户贷款收益率下降的影响。资产质量方面,交通银行的不良贷款余额和不良贷款率均有所下降,但逾期贷款余额和逾期贷款率均有上升。

3 月 27 日,交通银行发布 2023 年年报。

年报显示,报告期内,交行实归属于母公司股东 927.28 亿元,同比增长 0.68%;实现营业收入 2575.95 亿元,同比增长 0.31%。截至报告期末,交行资产总额达 14.06 万亿元,较上年末增长 8.23%。

2023 年,交行董事会建议普通股每股分配现金股利人民币 0.375 元,共计人民币 278.49 亿元,占净利润的 32.67%,这是交行现金分红率连续 12 年保持在 30% 以上。

此外,交行的第二大股东汇丰银行在去年意外增持交行也令人关注。

非息收入逆势增长

年报显示,2023 年,交行实现利润总额 996.98 亿元,同比增加 15.83 亿元,增幅 1.61%。

交行的利润增长主要来源于非利息净收入同比增加和信用减值损失同比减少。报告期内,非利息净收入同比增长7.55%,信用减值损失同比减少 5.80%。

利息净收入方面,交行去年交行实现利息净收入 1641.23 亿元,在净经营收入中占比为 63.61%,较上年减少 57.59 亿元,同比减少 3.39%。

年报中解释,利息净收入同比下降,主要是贷款市场报价利率 (LPR) 多次下调及存量房贷利率调整,客户贷款平均收益率下降导致利息收入增长不及预期,同时人民币存款延续定期化趋势叠加外币负债成本上行影响,利息支出有所增加。

不良率下降,逾期率上升

资产质量方面,截至报告期末,交行整体不良贷款余额为 1056.88 亿元,较上年末增加 71.62 亿元;不良贷款率 1.33%,较上年末下降 0.02%。

与此同时,报告期内,交行公司类逾期贷款余额 622.73 亿元,较上年末增加 159.64 亿元,逾期贷款率 1.20%,较上年末上升 0.22 个百分点。个人逾期贷款余额 478.32 亿元,较上年末增加 93.49 亿元,逾期贷款率 1.93%,较上年末上升 0.30 个百分点。

交行董事会秘书何兆斌在业绩发布会上表示,交行逾期贷款总额较年初增长 252.92 亿元,也反映了当前在风险管控方面面临的挑战和压力。

何兆斌认为,虽然资产质量存在多方面压力挑战,但随着国家调控政策效果逐步显现,自上而下的重点领域风险化解措施愈发务实有效,相信今年经济回升向好态势将进一步巩固和增强,社会预期持续改善,重点领域风险化解逐步取得成效,企业和居民还款能力稳步提升,这些因素都将对银行整体资产质量的稳定改善形成正向推动。

与此同时,交行也在持续完善全面风险管理体系,优化授信管理流程,提升各类风险管理能力,加强重点领域项目风险处置化解。

“我们有信心保持全年资产质量平稳向好。” 何兆斌说。

有信心保持业绩和分红率稳定

2023 年,董事会建议普通股每股分配现金股利人民币 0.375 元,共计人民币 278.49 亿元,占净利润的 32.67%。目前交行的 A 股、H 股股息率近 6%、8%。

交行董事会秘书何兆斌表示,自 2012 年以来,交行现金分红率连续 12 年保持在 30% 以上(2012-2023 年度)。最新分红方案相较上年略有提升。

关于分红政策,尽管当前经营面临一些挑战,但有信心能够保持整体业绩和分红率稳定,让股东可以持续分享交行经营发展成果。

汇丰银行四季度增持 1.93万股交行 A股

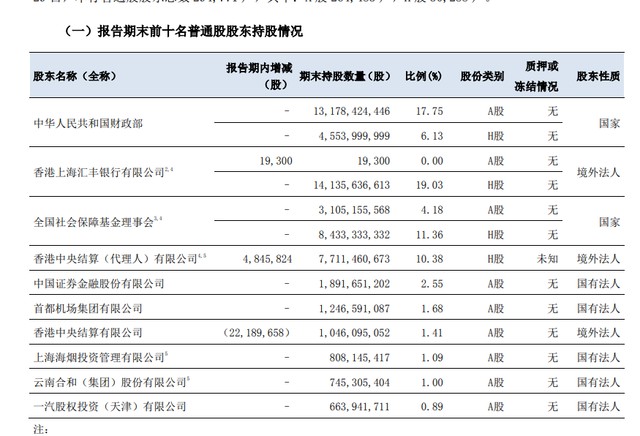

股东方面,年报显示,2023 年四季度,交行第二大股东香港上海汇丰银行有限公司增持 19300 股交行 A 股。

截至 2023 年末,根据交行股东名册,汇丰银行持有交行 A 股 19300 股、H 股 138.86 亿股。