Tax season in the United States, individual investors are tight on funds! They collectively flock to high-leverage ETFs

美国散户在报税季节购买股票减少,但对高杠杆交易所交易基金的兴趣增加。散户资金流入四个最受欢迎的交易所交易基金,包括标普 500 指数 ETF、纳指 100 ETF、3 倍做多纳指 ETF 和 3 倍做多半导体 ETF。个人投资者使用杠杆的情况明显增加,但这也使得他们更容易受到股票回调的影响。散户交易活动可能会在 5 月初开始增加。

智通财经 APP 获悉,在美国每年 4 月 15 日的税期前夕,个人投资者购买股票的数量似乎因季节性原因而减少,但与此同时,他们对高杠杆交易所交易基金 (ETFs) 的兴趣却在升温。

Vanda Research 的 Marco Iachini 和 Lucas Mantle 在周三的一份报告中指出,散户资金往往会受到美国 4 月中旬所得税截止日期的影响,今年也不例外。他们发现,现金股票购买量略低于后新冠疫情时期的平均水平,位于第 44 百分位附近。他们表示,交易活动可能会在 5 月初开始增加,正好赶上英伟达 (NVDA.US) 2024 财年第一季度的财报电话会议。

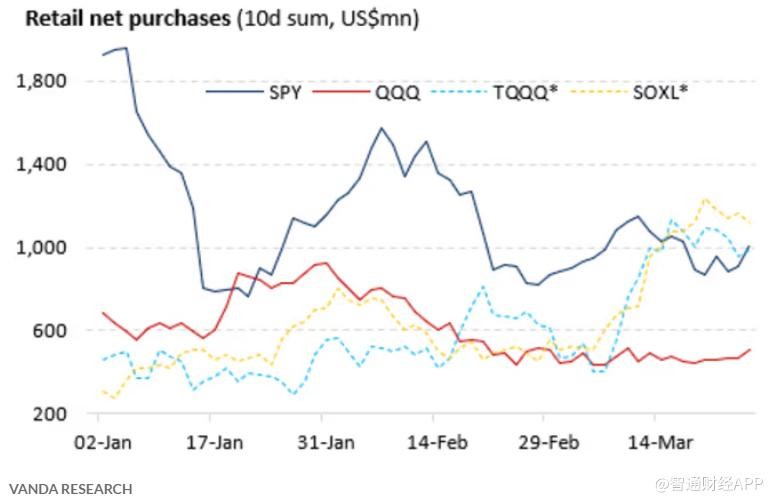

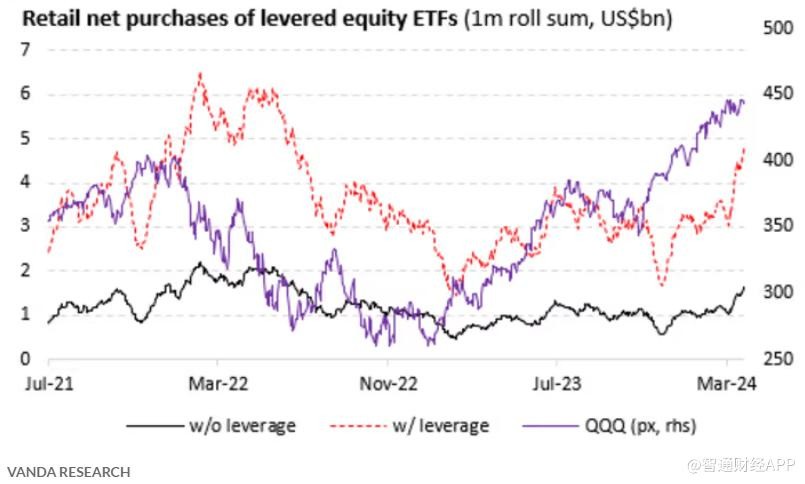

然而,他们指出,最近几周个人投资者使用杠杆的情况 “明显增加”。自年初以来散户资金流入四个被购买最多的交易所交易基金为标普 500 指数 ETF(SPY.US)、纳指 100 ETF(QQQ.US)、3 倍做多纳指 ETF(TQQQ.US) 和 3 倍做多半导体 ETF(SOXL.US)。

其中,TQQQ 旨在提供纳斯达克 100 的日收益的三倍 (扣除费用和开销之前) 涨跌幅,而 SOXL 旨在提供纽约证券交易所半导体指数的三倍涨跌幅。

Iachini 和 Mantle 表示:“投资者正试图通过投资杠杆 ETF 来让他们的资本产生更大的效益,我们对这种逻辑没有异议,但这确实使得散户更容易受到股票回调的影响。”