Pre-market trading in US stocks | Nio and Li Auto lead the decline in Chinese concept stocks! Trump concept stock DJT continues to soar

小鹏盘前领衔跌超 4%,蔚来跌超 3%,理想跌超 2%。特朗普概念股 DJT 一度涨超 16%。默克涨近 5% 势创新高。游戏驿站 GME 一度大跌 23%。One Group 一度涨近 15%。PaySign 一度涨超 32%。Robinhood 一度涨超 8%。

美股要闻

1、3 月 27 日,中国国家主席习近平在北京人民大会堂集体会见美国工商界和战略学术界代表。习近平指出,中美关系史是一部两国人民友好交往的历史,过去靠人民书写,未来更要靠人民创造。希望两国各界人士多来往、多交流,不断积累共识。

2、蔚来下调一季度交付预期:预计第一季度交付量为 30000 辆,此前预计为 31000 至 33000 辆。

3、淘宝 3 月 27 日宣布,4 月起将面向全平台商家推出多项惠商举措,包括生意参谋、店小蜜客服机器人、图片空间等重要经营服务即将向商家免费提供。

4、继 xAI 在 3 月早些时候开源其 Grok 大型语言模型之后,马斯克周二表示,X 将很快向更多付费用户提供 Grok 聊天机器人。

5、阿斯利康计划 “同种药物全球多厂生产”,以便独立供应不同市场。

盘前异动

美股盘前,三大股指期货上涨,恐慌指数下跌。

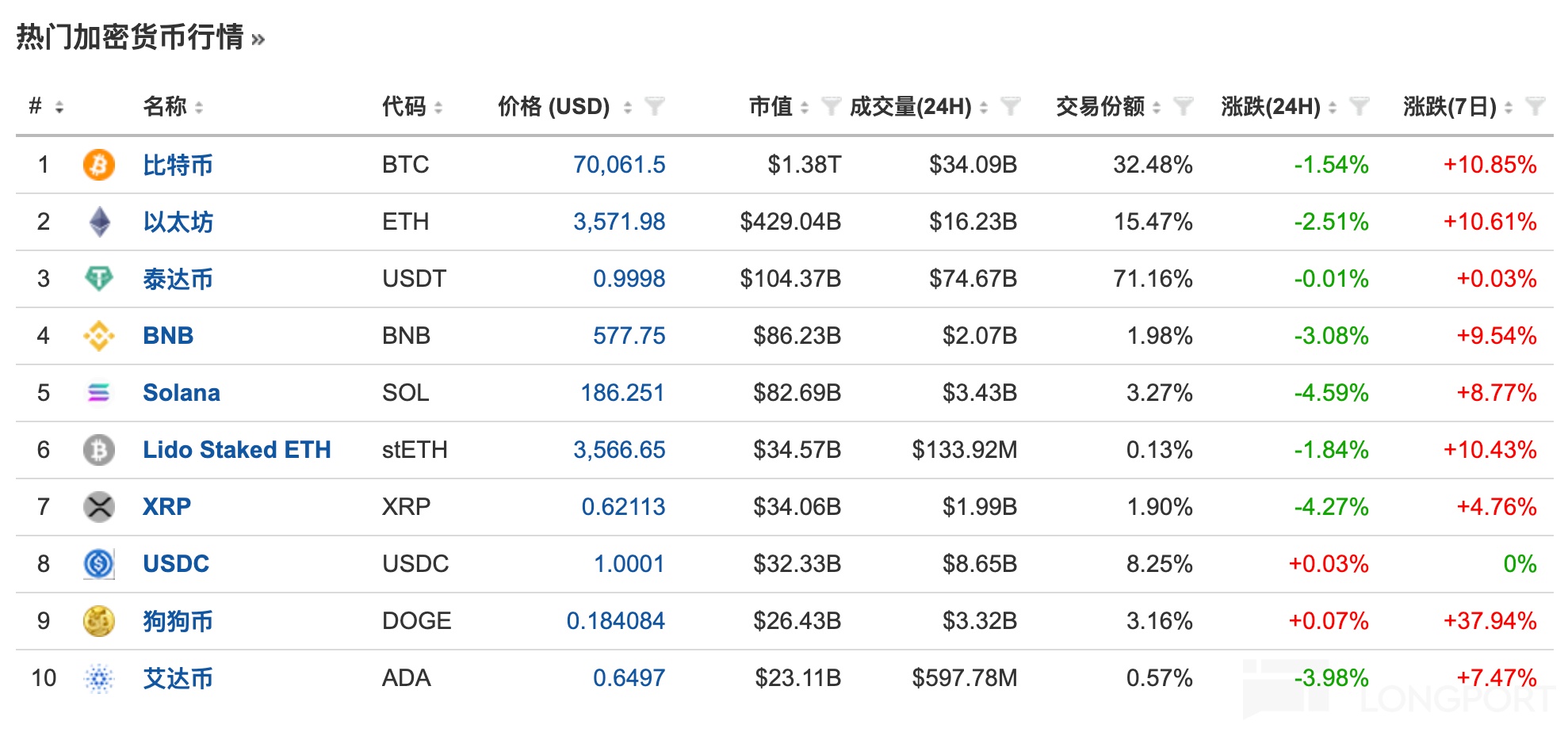

比特币现报 70061 美元,24 小时跌超 1%;以太坊现报 3571 美元,24 小时跌超 2%。

中概股盘前普跌,科技股、加密货币概念股普涨。

小鹏领衔跌超 4%,蔚来跌超 3%,理想跌超 2%,百度、阿里、拼多多跌超 1%,京东、哔哩哔哩跌近 1%。

特斯拉、英伟达涨近 1%,AMD、Meta、苹果、亚马逊、微软上涨。

Coinbase 涨超 1%,Marathon Digital、Microstrategy 涨近 1%。

个股方面,特朗普概念股 DJT 盘前一度涨超 16%,此前一天收涨 16%。

默克涨近 5% 势创新高,肺动脉高压药物 sotatercept 获 FDA 批准。

One Group 一度涨近 15%,拟 3.65 亿美元收购红花控股。

PaySign 一度涨超 32%,Q4 业绩超预期。

游戏驿站 GME 一度大跌 23%,Q4 业绩不及预期。

Robinhood 一度涨超 8%,进军美国信用卡业务。

策略回顾

1、特朗普概念股 DJT 做空数据暴增!

DJT 上市首日虽然一度大涨至熔断、最终也收涨 16%,但其做空比例已经达到 60%,超 400 万的做空股数,接近前一天 DWAC 做空股数的 4 倍!

2、加密货币概念股越涨越被做空!轧空行情要来了?

今年加密货币股票的空头头寸总额已经增加到近 110 亿美元,超过 80% 都是针对 MSTR 和 COIN。鉴于这些股票反弹和可供卖空的股票数量有限,可能会出现轧空行情,即空头被迫买回股票以退出头寸,从而推高股票价格。

3、美国散户再次掀起 meme 股热潮!

个人投资者的期权交易量小幅上升,因为交易员买入看涨期权,以应对本已存在泡沫的股指持续上涨。他们抢购刚上市的 Reddit 股票,同时也买入了游戏驿站等经典 meme 股票。