Antitrust case settled! $30 billion over 5 years! Visa, Mastercard agree to lower fees, US merchants impacted

分析认为,虽然 Visa 和万事达卡设定了这些费用的水平,但实际上收取大部分收入的是发行信用卡的银行。这意味着包括摩根大通、美国银行和花旗集团在内的发行 Visa 和万事达卡的银行,可能会因这项协议而受到冲击。

Visa 和万事达卡公司周二与原告商家达成一项和解协议,两家信用卡公司同意限制信用卡刷卡费。美国商家表示,这将在五年内为他们节省至少 300 亿美元。

信用卡刷卡费也被称为交换费,是信用卡发行方利润的主要驱动力,是用来支持信用卡奖励计划的主要机制。

这起诉讼持续了将近 20 年,为近年来规模最大的反垄断和解之一。媒体报道,作为和解协议的一部分,Visa 和万事达卡同意至少三年内降低他们向每个商家收取的刷卡费至少 4 个基点。而且,在五年的时间内,两个信用卡网络的平均刷卡费必须至少比当前平均值低 7 个基点,并接受独立审计师的审核。

同时,和解协议还将允许零售商在结账时,对使用 Visa 或万事达卡的消费者收取额外费用,商家将能够根据接受不同信用卡的成本调整收费,使用定价策略引导顾客使用商家支付成本较低的支付卡。

例如,持有 Visa Infinite 标志、刷卡费因此更高的 Chase Sapphire Reserve 卡的消费者,在结账时被收取的金额,可能比使用 Chase Freedom Unlimited 卡的顾客更多。此外,商家现在也将被允许为使用某银行信用卡的消费者提供折扣。

近年来,商家对刷卡费的反对声音越来越高,这些费用通常占购买金额的约 2%,去年总计超过 1000 亿美元。虽然 Visa 和万事达卡设定了这些费用的水平,但实际上收取大部分收入的是发行信用卡的银行。

这意味着包括摩根大通、美国银行和花旗集团在内的发行 Visa 和万事达卡的银行,可能会因这些让步而受到冲击。例如,摩根大通去年收取了 310 亿美元的刷卡费和商户处理收入,计算信用卡奖励、支付给合作公司的款项及其他成本后,总计收入为 48 亿美元。

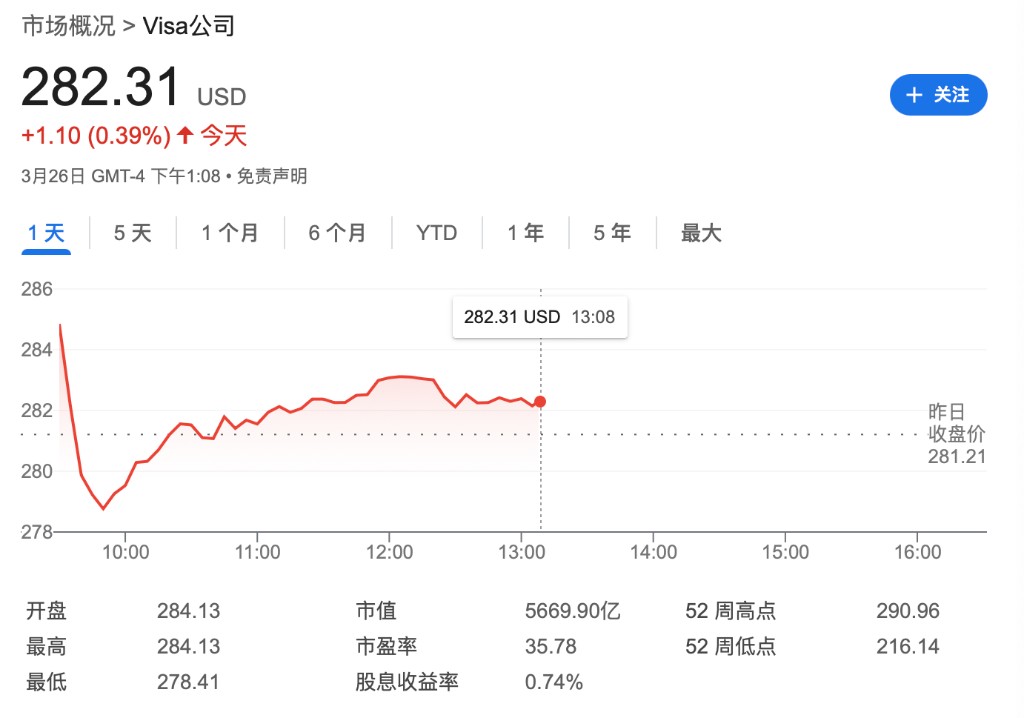

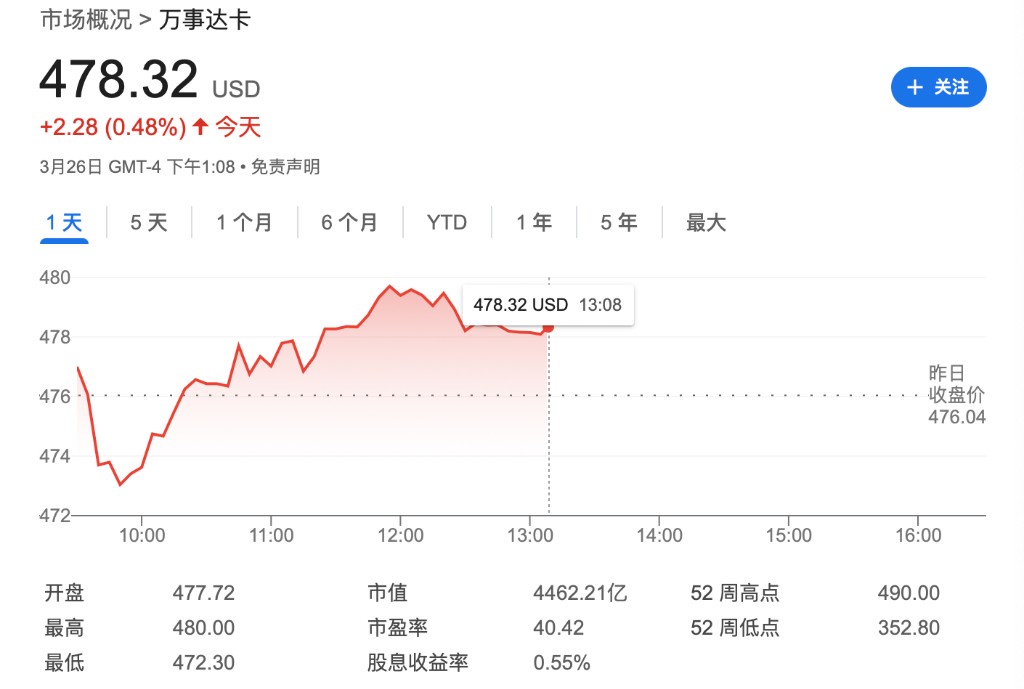

周二美股午盘,摩根大通、美国银行、花旗集团、Visa 和万事达卡的股价都略有上涨。

大约五年前,Visa 和万事达卡在另一项和解协议中同意向数百万商家支付大约 60 亿美元。虽然那项协议解决了与诉讼相关的财务损失,但没有解决商家对刷卡费和其他担忧。

分析认为,这项最新和解协议应该有助于解决那些讨厌 Visa 和万事达卡 “尊重所有卡片” 规则(honor all cards)的商家的痛点,这些规则规定,如果商家接受该品牌的一张信用卡,那么它必须接受该品牌的所有信用卡。一些零售商表示,这些规则是近年来刷卡费激增的原因,因为 Visa 和万事达卡与银行合作发行了更多运行在它们的高级网络上的卡片,这通常会让零售商付出更多成本。

万事达卡随后发布声明称,“这项协议通过为商家提供实质的确定性和价值,包括他们管理信用卡项目接受度的灵活性,为长期争议带来了解决。”

“我们已经达成了一个包含有意义让步的和解,这些让步解决了小企业识别出的真正痛点,” Visa 在另一份声明中说。“重要的是,我们在做出这些让步的同时,也维持了安全性、创新、保护、奖励和信用获取的能力。”