Pre-market trading in US stocks: Tesla fell nearly 4%, XPeng-W fell nearly 5%, leading the decline in Chinese concept stocks!

据称,由于电动汽车销售增长放缓,特斯拉削减在中国市场的汽车产量。中概股盘前普跌,小鹏跌近 5%,京东、哔哩哔哩、理想跌超 2%,阿里、拼多多、蔚来、百度跌超 1%。Lululemon 跌近 13%,耐克跌超 6%,联邦快递涨近 13%。

美股要闻

1、美团第四季度营收 737.0 亿元人民币,预估 727 亿元人民币;营业利润 17.6 亿元人民币,预估 13.4 亿元人民币;净利润 22.2 亿元人民币,预估 10.9 亿元人民币;调整后净利润 43.7 亿元人民币,预估 29 亿元人民币。

2、界面援引消息称,由于电动汽车销售增长放缓,特斯拉削减在中国市场的汽车产量。

3、英伟达 GTC 大会上,快手携手英伟达宣布了基于 Hopper 架构的推荐系统最新进展:通过将部分 CPU 负载迁移到 GPU、深入分析和优化 GPU 性能瓶颈、实施面向吞吐量的内核融合以及其他一系列措施,成功解决了系统瓶颈问题,进而将推荐效率提升了整整 20%。

4、腾讯音乐董事会调整:谢振宇辞任腾讯音乐总裁及 CTO 等职务,同时任命 CFO 胡敏为集团董事。

5、由于水可能渗入变速器控制线束,导致短路,并将变速器从驻车档切换至空档,现代汽车将召回部分 2024 年款 Genesis GV70 汽车,共计 15645 辆。

6、空中客车官方微博宣布,已获得来自两家亚洲航空公司的飞机订单。其中,日本航空宣布增购 21 架 A350-900 飞机,并承诺订购 11 架 A321neo,这是日本航空首次订购空客单通道飞机;大韩航空宣布订购 33 架 A350 系列飞机。

盘前异动

美股盘前,三大股指期货上涨,恐慌指数下跌。

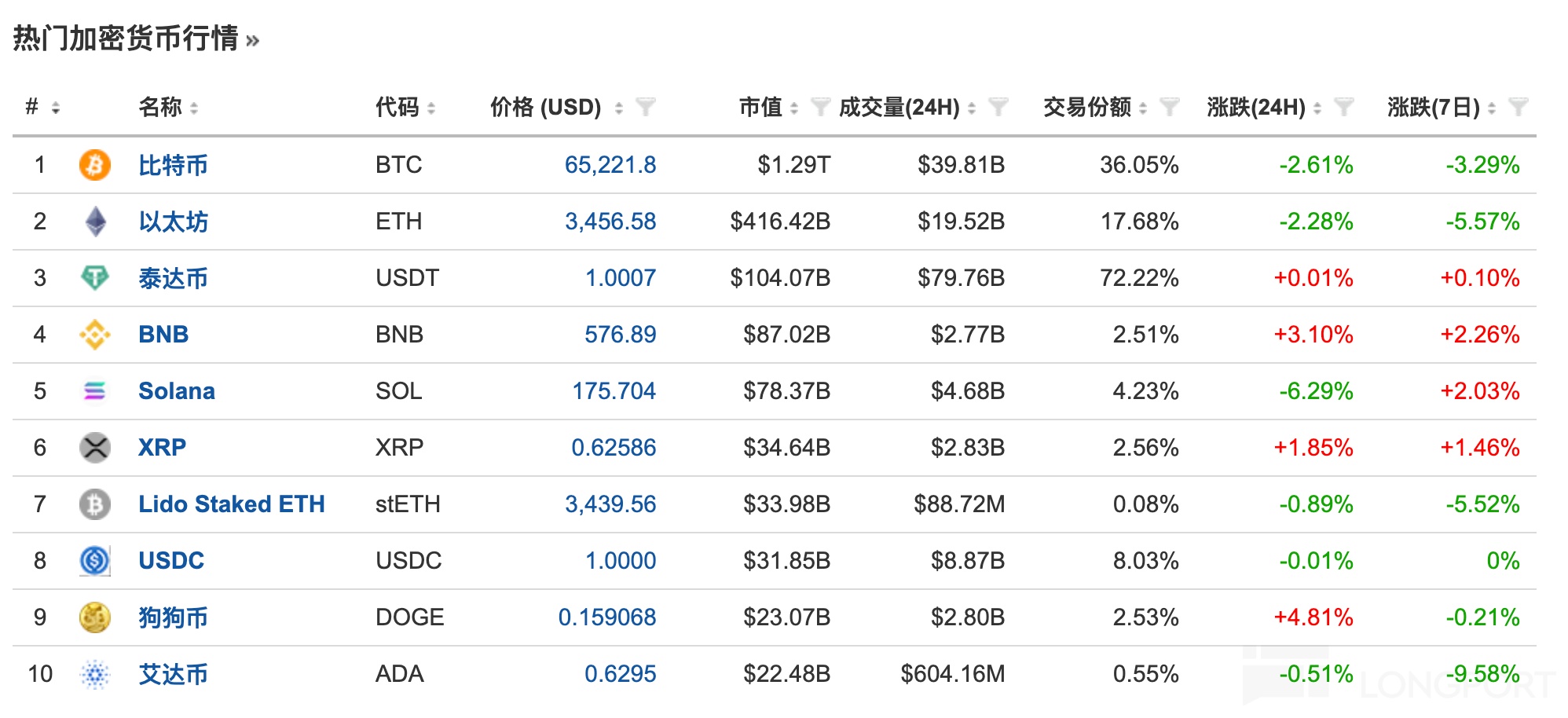

比特币现报 65221 美元,24 小时跌超 2%;以太坊现报 3456 美元,24 小时跌超 2%。

科技股中,仅特斯拉盘前跌近 4%,英伟达、AMD、苹果等悉数上涨。

中概股普跌,小鹏跌近 5%,京东、哔哩哔哩、理想跌超 2%,阿里、拼多多、蔚来、百度跌超 1%。

个股方面,Lululemon 跌近 13%,Q1 及全年销售指引不及预期。

耐克跌超 6%,Q3 营收同比增幅仅 0.3%,2025 财年指引悲观。

联邦快递涨近 13%,Q3 调整后 EPS 超预期,宣布 50 亿美元股票回购计划。

策略回顾

1、又一个里程碑式反垄断!1998 年微软被分拆,苹果这次会重蹈覆辙么?

苹果与司法部的 “大战” 将是一场关乎反垄断法改革更新,影响科技行业命运的 “马拉松 ”。

2、“超买回调” 警报拉响! 比特币或将迎来 2024 年最差单周表现

“事实上,此次比特币的涨势并没有像以前那样从历史高点起飞,这让很多人质疑比特币这波大牛市的最终力度。比特币减半即将到来,如果这一事件未能使得比特币的价格真正保持势头,那么这意味着我们将面临严重的回调,这意味着价格短期内有可能将跌至 5 万美元以下。”

3、美联储比市场预期更鸽派! 6 月降息是大势所趋?

美联储青睐的核心 PCE 数据可能会让市场感到一些安慰。虽然核心 PCE 物价指数同比涨幅仍保持在 2.8% 左右的高位,但呈下降趋势,未来几个月可能会进一步下降。而这可能会重新提振市场对美联储的降息预期,并支持美联储开启宽松周期。