Is the Federal Reserve more dovish than market expectations? Is a rate cut in June inevitable?

美联储公布的最新点阵图显示,政策制定者预计今年年底前将降息三次,表明比市场更鸽派。市场预计在 6 月至少会降息 25 个基点的可能性约为 76%,在 7 月或之前降息的可能性接近 90%。美联储似乎按计划行事,标普 500 指数今年已涨近 10%。投资者对美联储的看法波动过大,从最初预期 2024 年有六次降息,到现在开始质疑是否会在夏季降息。市场对鸽派立场持乐观态度,预计标普 500 指数到年底可能涨至 5800-6000 点区间。

智通财经 APP 获悉,近期一系列数据所展现的通胀粘性与美国经济韧性让一些投资者预期,美联储可能会在本周的政策会议上倾向于更强硬的立场,并可能引发一次市场回调。然而,美联储周三公布的最新点阵图显示,政策制定者仍预计今年年底前将降息三次。这种动态表明,美联储比市场最近所反映的更为鸽派。

此外,美联储主席鲍威尔表示:“美联储实现通胀和就业目标的风险已经达到了更好的平衡。” 鲍威尔还暗示,量化紧缩 (QT) 应该放缓步伐、并可能很快结束。持续的货币政策转向意味着,美联储可能很快就会开启降息周期,并可能在必要时为明年新一轮的量化宽松打开大门。

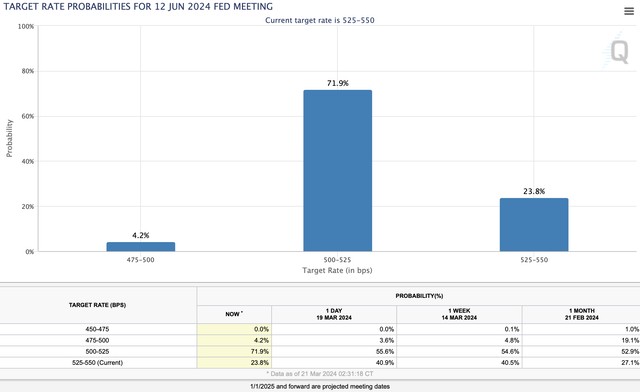

在美联储公布利率决议之后,市场目前预计,美联储在 6 月至少降息 25 个基点的可能性约为 76%,高于公布利率决议之前的 60% 左右。因此,市场预期正朝着更快降息的方向发展,而不是此前预期的在更长时间内维持高利率。此外,市场认为,美联储在 7 月或之前降息的可能性已经接近 90%,甚至有大约 40% 的可能性在 7 月底之前出现两次降息。

当然,市场喜欢美联储这种鸽派立场。标普 500 指数今年已涨近 10%,尽管近期可能会出现轮换/盘整/回调,但未来可能仍会有相当大的上行空间。美联储似乎正在按计划行事。有分析人士指出,由于围绕市场和经济的建设性因素,标普 500 指数到年底可能涨至 5800-6000 点区间。

近段时间以来,投资者们对美联储及其货币政策的看法波动过大。年初时,市场还过于乐观地预期 2024 年将有六次降息。而最近,许多市场参与者开始质疑美联储是否会在夏季降息、将首次降息的预期推迟到了秋季,甚至还有人认为美联储可能会在未来几个月重新加息。

市场变得如此鹰派,原因在于美国劳动力市场依然强劲、通胀仍处于高位且表现出粘性。美国 CPI 同比涨幅在 2023 年 6 月跌至 3% 的低点,自那以后便一直徘徊在 3.1%-3.7%。除了 CPI 之外,PPI 在过去两个月也都超出预期,引发了市场对通胀重新抬头的担忧。

不过,美联储青睐的核心 PCE 数据可能会让市场感到一些安慰。虽然核心 PCE 物价指数同比涨幅仍保持在 2.8% 左右的高位,但呈下降趋势,未来几个月可能会进一步下降。而这可能会重新提振市场对美联储的降息预期,并支持美联储开启宽松周期。