US Stock Options | Market cools down! Tesla, NVIDIA, AMD all see a sharp drop in trading volume!

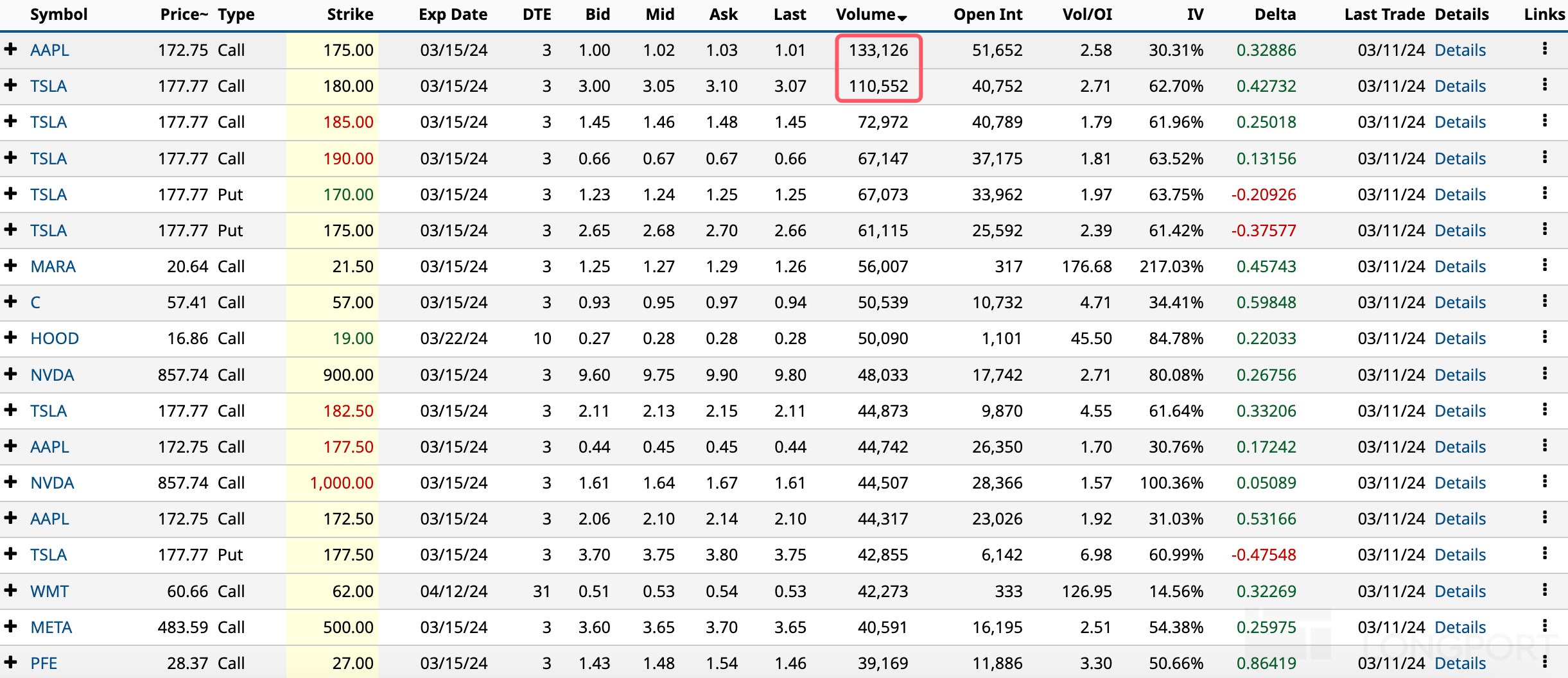

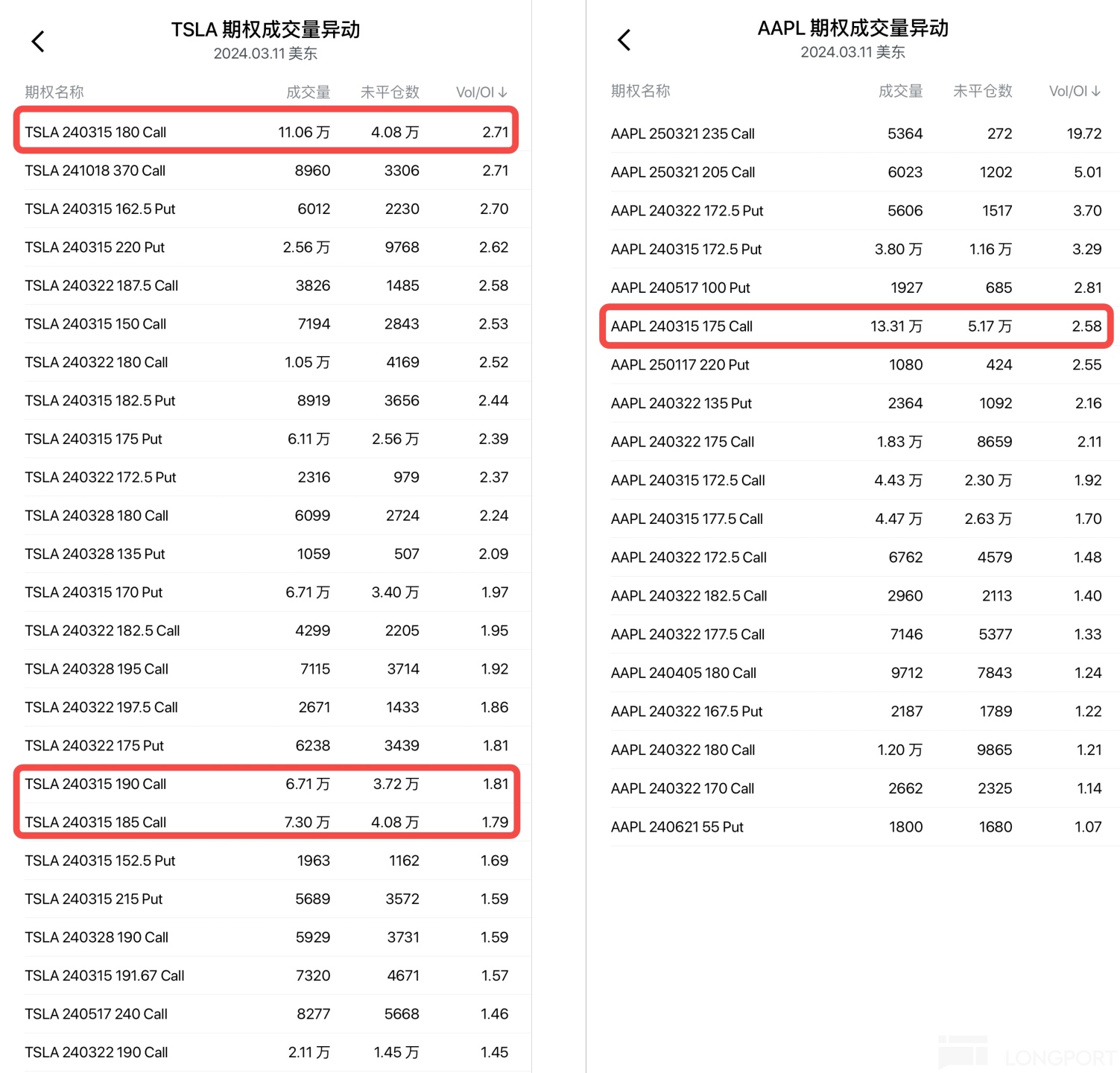

隔夜最火合约:3 月 15 日到期、执行价 175 美元的苹果 call,成交超 13 万张。执行价 180 美元的特斯拉 call 成交 11 万张,执行价 900 美元的英伟达 call 成交不足 5 万张。

隔夜,Meta 领跌蓝筹科技股,芯片股指连续两日跑输大盘。

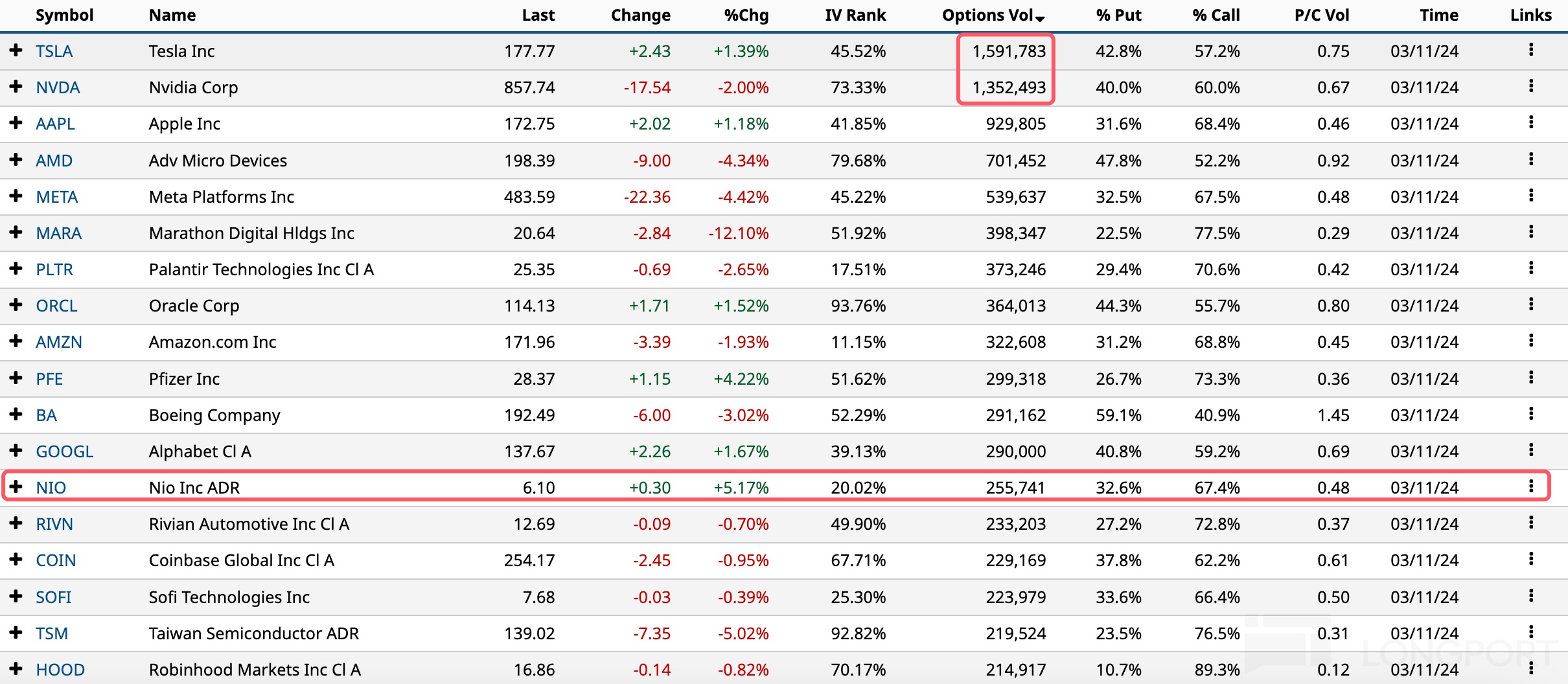

美股期权成交概览

隔夜前十大美股期权成交:特斯拉、英伟达、苹果、AMD、Meta、Marathon Digital、Palantir、甲骨文、亚马逊、辉瑞。

其中:

特斯拉涨超 1%,期权成交大幅回落至 159 万张,看涨期权占比 57%。3 月 15 日到期、执行价 180 美元的看涨期权成交 11 万张,执行价 185 美元和 190 美元的看涨期权分别成交超 7 万张和 6 万张。

英伟达跌 2%,期权成交暴跌至 135 万张,看涨期权占比六成。执行价 900 美元的看涨期权成交不足 5 万张。

苹果涨超 1%,期权成交回落至 93 万张,看涨期权占比 68%。执行价 175 美元的看涨期权成交超 13 万张,为隔夜最火合约。

AMD 跌超 4%,期权成交暴跌至 70 万张,看涨期权占比 52%。

Meta 跌超 4%,期权成交微幅回落至 54 万张,看涨期权占比 67.5%。执行价 500 美元的看涨期权成交 4 万张。

Marathon Digital 大跌 12%,期权成交回落至 40 万张,看涨期权占比 77.5%。

Palantir、甲骨文、亚马逊期权成交均超 30 万张,均以看涨期权为主。

辉瑞涨超 4%,期权成交大涨至 30 万张,看涨期权占比 73%。执行价 27 美元的看涨期权成交 4 万张。

波音跌超 3%,期权成交大涨至 29 万张,看跌期权占比 59%。

蔚来涨超 5%,期权成交涨至 25 万张,看涨期权占比 67%。

台积电跌超 5%,期权成交腰斩至 22 万张,看涨期权占比 76.5%。