Post-earnings boost pushes stock price close to the $500 mark, will Meta Platforms' upward trend peak soon?

Meta 在 2024 年表现强劲,股价逼近 500 美元大关。然而,公司面临减持和投诉等不利因素,可能导致股价回调。Meta 发布了成绩优异的第四季度财报,全年净利润增长 69%,宣布增加 500 亿美元股票回购,并将首次发放股息红利。公司四季度营收主要来自社交媒体平台的广告收入。

于过去一年屡创佳绩的 Meta(META.US) 在 2024 年表现仍然强劲。2 月初,该公司单日盘中触及历史新高,至收盘市值增加约 2000 亿美元,创下美股史上最强单日市值增长纪录。

随后,Meta 发布了成绩优异的第四季度财报,且首次宣布派发季度股息,推动市场热情持续高涨。如今,公司股价位于 490 美元附近,较 1 月底已上涨近三成。

然而,在迈入 “万亿俱乐部” 的喜悦背后,风头正劲的 Meta 依然面临着一些不利因素。第四季度,摩根士丹利减持了 META 股票,持仓比例从 1.13% 下降至 1.11%;Meta 平台在欧洲也面临大量投诉,8 家消费者组织指责 Meta 向用户付费提供无广告版本的举措并不公平。在投资者由财报带来的热情冷却后,这些负面事件或将导致公司股价产生一定程度的回调。

降本成效显著 全年净利大增 69%

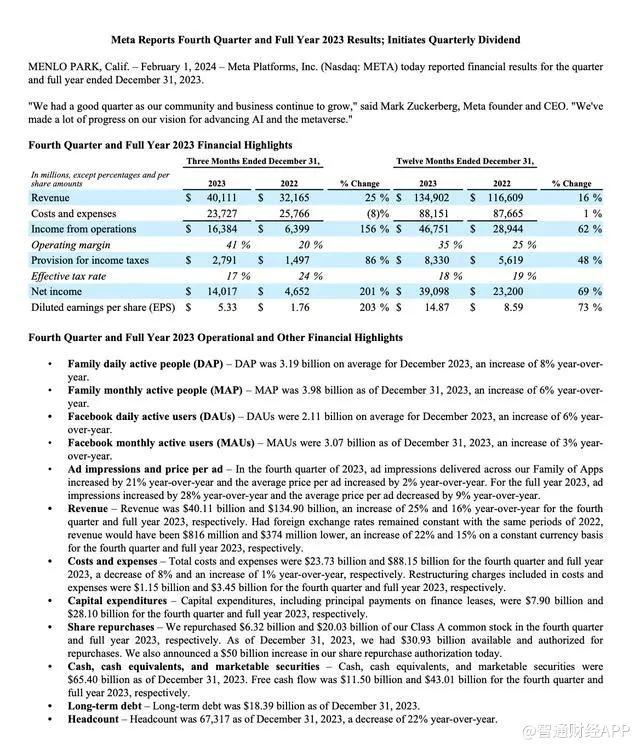

根据公司近期公布的财报,在截至 2023 年 12 月 31 日的 2023 财年第四财季,实现营收 401.11 亿美元,较去年同期增长 25%,高于市场预期的 389 亿美元,也是 Meta 自 2021 年三季度以来最大的营收增幅;净利润同比增长 201% 至 140.17 亿美元,高于市场预期的 128.90 亿美元;摊薄后每股收益同比增长 203% 至 5.33 美元,高于市场预期的 4.95 美元。

至此,Meta 在 2023 年全年营收 1349.02 亿美元,同比增长 16%;净利润则实现惊人增幅,同比增长 69% 至 390.98 亿美元。

由于录得喜人业绩,Meta 宣布增加 500 亿美元股票回购,将在今年三月进行公司史上首次发放股息红利,包括 A 类普通股和 B 类普通股,每股派发 0.50 美元现金。

分业务来看,Meta 四季度营收主要由来自社交媒体平台的广告收入所贡献,该季度营收 387.06 亿美元,占总营收的 96% 以上。依靠广告收入,包括 Instagram、Facebook 和 WhatsApp 在内的 Meta 应用系列 Family of Apps(FoA) 四季度营收达到 390.40 亿美元,同比增长 24%。

其中,Facebook 的日活跃用户 (DAU) 在去年 12 月达到 21.1 亿,月活跃用户达到 30.7 亿,均超出研究机构预期。

值得注意的是,自 2023 年起 Meta 采取了 “降价提量” 策略,2023 全年广告均价同比下降 9%,但全年广告投放量同比上升 28%。在财报电话会议上,公司管理层还表示,2023 年来自中国广告主的收入占 Meta 总收入的 10%,对全球总收入增长贡献了 5 个百分点。

而在其他业务方面,元宇宙相关部门、负责 AR 和 VR 业务的 Reality Labs 依然属于 “赔本赚吆喝”,四季度亏损额达到 46.46 亿美元,高于去年同期的 42.79 亿美元。2023 年全年,该部门的总亏损额达到 161.20 亿美元,相比上年的 137.17 亿美元又增加了不少。

从全年成本压力有所降低来看,2023 年年初起采取的开源节流策略显然起到了一定成效,在平衡对 AI 和 VR 等技术的巨额支出的同时,依然保持了业绩增长。据智通财经 APP 了解,截至 2023 年 12 月 31 日,Meta 已经完成了数据中心计划、裁员计划和设施整合计划,Q4 总成本和费用同比减少 8% 至 237 亿美元,运营利润率在 2023 年全年从上年的 25% 提升至 35%。

对此,Meta 首席执行官马克·扎克伯格 (Mark Zuckerberg) 表示:“随着社区和业务持续增长,我们度过了一个不错的季度。在推动 AI(人工智能) 和元宇宙的愿景方面,我们取得了很大的进展。”

展望未来,Meta 预计在下一财季,公司营收将达到 345 亿美元至 370 亿美元之间,高于分析师预期的 336.4 亿美元,但并未提供全年业绩指引。

在风靡科技界的 AI 热潮方面,公司也将继续追加投入,预计其 2024 年全年的资本性支出将在 300 亿至 370 亿美元之间,比三个月前给出的 300 亿到 350 亿美元的指引有所上升。Meta 透露,公司正在加速建设新数据中心架构的站点,并在数据中心内部署新版自研定制芯片。

元宇宙转机未至,亏损料将持续

尽管广告业务一路高歌猛进,但元宇宙商业化前景的遥遥无期,使得 Meta 对元宇宙的巨额投入成为了投资者普遍担忧的因素。

据智通财经 APP 了解,元宇宙是整合多种新技术而产生的新型虚实相融的互联网应用和社会形态,它基于扩展现实技术提供沉浸式体验,以数字孪生技术生成现实世界的镜像,通过区块链技术搭建经济体系,将虚拟世界与现实世界在多方面密切融合。

自 2021 年 “元宇宙发展元年” 以来,尽管元宇宙概念前景广阔、呼声甚高,但由于各方面技术、内容和生态都尚不成熟,至今仍然停留在起步阶段,即使是进展领先的 AR/VR 领域也迟迟未能建立起成熟的商业化生态。

受到全球经济形势动荡的影响,尽管索尼和 Meta 在这一年均推出了备受瞩目的新产品,但全球 AR/VR 头显市场的增长速度仍有所放缓。根据国际数据公司 (IDC) 预测,2023 年全球增强现实 (AR) 以及虚拟现实 (VR) 头戴式显示器的出货总量预计将达 810 万台,仍未达到千万量级,且较上年同期下降约 8.3%。

IDC 指出,截止 2023 年末季,Meta 公司已经稳坐全球 AR/VR 设备市场头把交椅,占有率高达 55.2%。这一年,公司发布了 Meta Quest 3,128GB 定价 499.99 美元起。其最重要的升级在于全彩透视,彩色透视的像素比前代高 10 倍,设备整体也轻薄了许多。

2024 年,Meta 预计将公开展示公司首款真正的 AR 眼镜原型 Orion 猎户座,2027 年将推出第一款向公众出售的 AR 眼镜 Artemis 阿尔忒弥斯。公司显然对 Orion 寄予厚望,声称该产品采用了 “军用级别” 的特殊碳化硅,价格并非普通消费者能够承担,且短期内无法大量生产。若该产品发布后超出预期,或将为 VR/AR 行业带来一定振奋情绪。

与此同时,Meta 方面也坦承,尽管未来还将持续投入大量资金,但预计短期内 RealityLab(RL) 业务将不会扭亏为盈。

重金押注 AI 大模型,不确定性仍存?

相比起 “波澜不惊” 的 XR 行业,Meta 在 AI 业务上的进展或许对其市场估值的提升更有帮助。

2023 年,Meta 轮番推出了大语言模型 LLaMa、多种 AI 应用及 MetaAI 助理,目前已在 APP 中推出超过 20 种的 AI 工具。2024 年,公司还计划推出大模型 LLaMa3、扩展 Meta AI 助手的实用性以及推进 AI Studio 路线图。

据智通财经 APP 了解,Meta 的长期战略目标是构建开源通用 AI 模型,该公司计划利用约 35 万块来自英伟达的 H100 GPU 以提高算力,届时 Meta 将拥有接近于 60 万块 H100 所能提供的算力。

借助于旗下社交平台提供的海量数据和内容,Meta 在 AI 大模型训练上具备独特的优势,但如此重注是否能真正转化为竞争优势尚未可知。据此计划,仅仅在购买芯片这一项支出上公司的花费就或将高达约 87.5 亿美元,如果公司最终未能在投入和产出中找到平衡,这样的豪赌可能最终以失败收场,并大幅拖累公司业绩。

此外,围绕社交媒体数据安全的争议始终是蒙在 Meta 前景上的一片阴影。2023 年 11 月,Meta 遭到来自美国 41 个州和华盛顿特区的总检察长组成的联盟起诉,指控这家公司旗下的脸书等社交平台非法收集 13 岁以下用户的个人账户信息和数据,并内置令人上瘾的功能,对儿童的心理健康造成危害。若诉讼结果不利,该公司可能会被处以高达数亿美元的罚款。

展望未来,公司核心的广告业务有望保持高速增长,而即将发布的 AI 产品和 Quest 头显等 XR 产品将成为市场的关注重点。此外,关于数据安全与 AI 的政策监管风险、XR 产品出货不及预期等风险亦不容忽视。