After hitting new highs, BlackRock and Morgan Stanley continue to be bullish on the Japanese stock market!

贝莱德称日股还会继续 “突破新高”,摩根士丹利则表示,日经突破新高可能 “只是一个开始”。

日本股市势如破竹,日经 225 指数上周打破 1989 年金融泡沫破裂前创下的纪录之后,周一再度刷新历史新高,东证指数也正在逼近自己的历史纪录。

屡创新高之际,华尔街大行贝莱德和摩根士丹利继续看涨日股,前者重申了对日股的增持评级,称可能继续 “突破新高”,后者则表示,日股并未释放出过热的信号,日经突破新高可能 “只是一个开始”。

贝莱德投资研究所 Jean Boivin 策略师团队当地时间周一发布报告表示,未来日股上涨仍有空间,强劲的盈利和企业治理改革将刺激进一步上涨。

该团队写道:

我们认为宏观前景和公司层面的发展都将推动日股下一阶段继续上涨。

贝莱德还表示,日元疲软提振了企业在海外的盈利价值,市场前景仍然乐观,因为通胀上升将促使企业提高价格,对利润形成保护,而工资增长刺激了消费者支出。公司治理改革也是股市上涨的 “关键驱动力”,东京证券交易所推动公司提高盈利能力并向股东返还资金。

摩根士丹利持类似观点。

该机构 Sho Nakazawa 分析师团队在当地时间周一公布的财报中指出,尽管当前位置很高,各种指标表明当前日股市场并未过热:

日经指数当前的水平与 1989 年 12 月大致相同,但目前的名义 GDP 大约是当时的 1.4 倍。

截至 1989 年底,日经平均市盈率为 62 倍,大约是目前水平的 4 倍。而当时的每股收益为 622 日元,明显低于目前的 2373 日元。

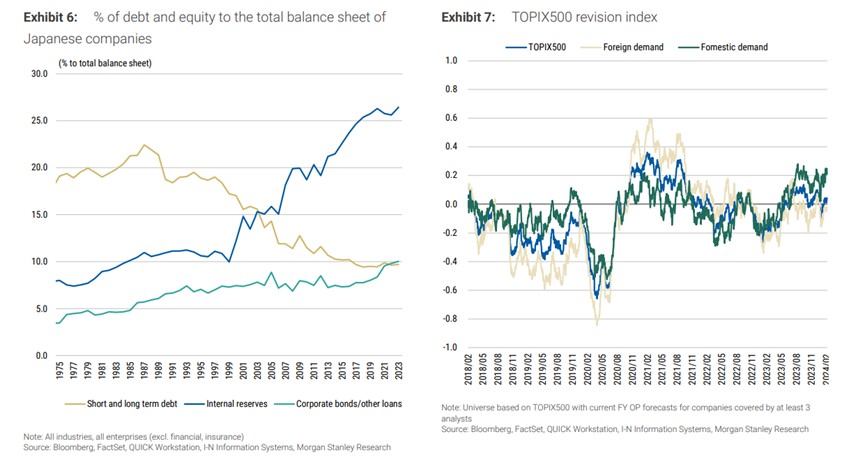

企业财务状况也明显强于 1989 年,当时债台高筑导致企业财务受到重创。自 1990 年代末金融危机以来,日本企业大多以股本替代债务的方式来增强财务实力。

种种迹象表明,日经指数的估值并不比 1989 年高,市场热度也不及 1989 年。

即使是横向对比,日股也并未释放出过热的信号。

Nakazawa 指出,日股的每股收益预期增幅将超过美国(以标普 500 指数为基准)和欧洲(以斯托克 600 指数为基准),但市盈率预期总体仍然比后两者低。

摩根士丹利认为,近几年来日股的涨势在很大程度上受到企业盈利的支撑,其程度比泡沫时期要大得多。未来日本企业资产负债表的效率还有很大提升空间。如果日本企业实现更高的资本效率,其估值可能会进一步增长。

因此,摩根士丹利得出以下结论:

日经指数创历史新高只是一个开始;维持日股进一步上涨的观点。