The cycle of the tech industry in the United States: NVIDIA's cash flow equals the capital expenditures of other tech giants.

这些巨额成本将会在未来几年降低科技巨头的利润。

英伟达因其亮眼的业绩被市场称为 “地球上最重要的股票”。但是,知名做空家 Jim Chanos 指出,在 AI 这场盛宴里,英伟达的亮眼业绩是其他科技巨头付出巨额成本换来的:英伟达利润增长的同时,科技巨头的成本在增加。

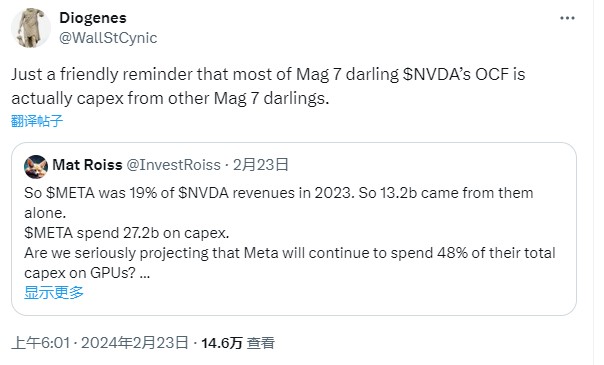

周四,知名做空家 Jim Chanos 在 X 平台上发帖表示:

“只是友好地提醒一下,英伟达的现金流来自于其他科技巨头的资本开支。”

“对于英伟达来说,英伟达出售的每一块芯片都直接增加了其财务报表上的收入和利润,因此,收入和利润可以即时反映出来。”

“但是对于其他科技巨头来说,这些资本化成本不立即作为费用计入利润表的支出,而是资本化在资产负债表上,并通过折旧或摊销在其使用寿命内分摊。这意味着这些芯片作为长期资产的成本会在未来几年内逐渐计入财务成本,而不是立即影响利润。然而,这些巨额成本将会在未来几年降低科技巨头的利润。”

“短期来看,而且科技巨头们延长了他们数据中心设备(如英伟达芯片)的折旧年限,这样每年计入利润表的折旧费用减少,短期内可以提升公司的报告利润。

Chanos 强调,英伟达正在赚取大量现金,这些现金可以用来运营和扩张业务、进行收购或向股东返还。与此同时,其大型科技客户却在花费巨资购买芯片,而这些芯片的价值会随着时间的推移而逐渐减少。而且,英伟达的快速扩张可能正在蚕食大型科技公司的增长机会和市场份额。

与此同时,深扒英伟达上周三发布的财报可以发现,英伟达的头号大客户为它贡献了 20% 的营收,约 120 亿美元,第二大客户贡献了 10% 的营收(截至去年 10 月的九个月内),约 39 亿美元。

据媒体报道,考虑到微软和 Meta 在 AI 和元宇宙领域的大量投资,这两家公司很可能就是英伟达的这两大客户。因此,这两家公司付出了巨额资本支出推动了英伟达的天文数字般的业绩增长。

目前来看,随着 AI 技术的发展和应用范围的扩大,对高性能计算能力的需求也在不断增加。英伟达的 GPU 以其高效的处理能力成为 AI 和深度学习任务的首选硬件。因此,英伟达的客户争先恐后地购买其芯片,为英伟达创造了巨额收益。

展望未来,情况可能会发生转变。媒体指出,AI 竞争愈演愈烈,科技巨头如微软和 Meta 可能会重新评估他们对芯片的需求,减少从英伟达购买芯片,或者转向自己制造芯片或寻找其他供应商。因此,英伟达当前的盈利增长势头可能会受到阻碍。