Gloomy outlook for the US electric car market: Tesla's stock price plummets, Ford Motor struggles to sell, and "new forces" warn of an industry massacre.

特斯拉股价年初至今累跌近 15%,福特过去半年已跌去 20%,“特斯拉劲敌” Rivian、国内三大新势力均 “血流不止”。

全球需求持续放缓、同行竞争白热化之际,2024 年电动汽车股开局不利,集体遭到投资者抛弃。

周五特斯拉险些连续第二日逆市下挫,早盘一度跌超 1%,午盘小幅转涨,全天涨近 0.2%,但仍接近去年 11 月 1 日以来收盘低位,年初至今累跌 14.6%。

宣布削减纯电动皮卡 F-150 Lightning 生产后,福特汽车周五早盘一度跌 4%,早盘尾声时转涨,收涨 1.9%。受销量低迷影响,福特股价过去半年已跌去 20%,福特警告称,2024 年全球电动汽车销量增长不容乐观。

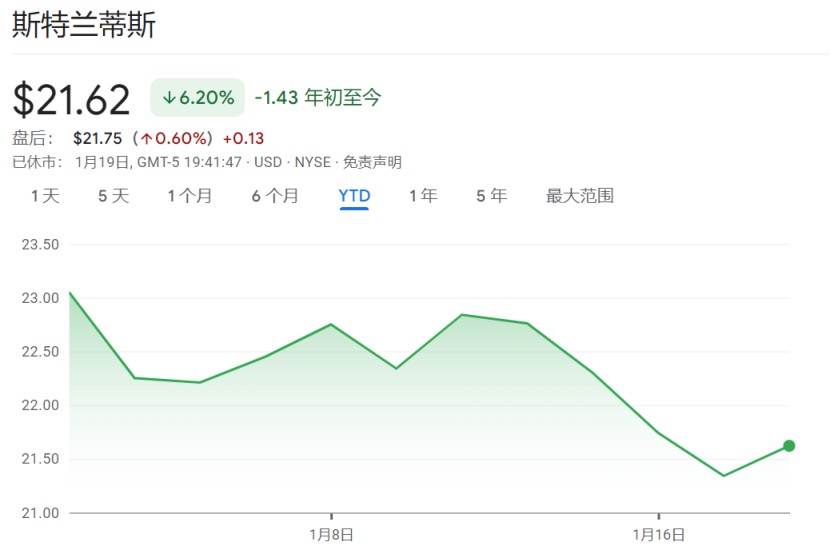

欧洲造车新势力 Stellantis 周五小幅收涨 0.28%,今年迄今已跌超 6%,公司首席执行官 Carlos Tavares 周五警告汽车制造商,车企过快降价可能会引发行业 “大屠杀”。

除了以上三家之外,绝大多数明星电动汽车制造商股价均血流不止。

美国电动汽车制造商 Fisker 周五跌 2.7%,今年以来 “腰斩” 51.6%;“特斯拉劲敌” Rivian 周五跌 1.7%,今年以来累跌 26.6%。

中概股方面,三家造车新势力均跑输大盘,小鹏、蔚来、理想周五分别跌 2.3%、3.5% 和 2.3%,今年以来分别累跌 34%、33% 和 25%。

中概股方面,三家造车新势力均跑输大盘,小鹏、蔚来、理想周五分别跌 2.3%、3.5% 和 2.3%,今年以来分别累跌 34%、33% 和 25%。

Stellantis:小心降价引发 “行业大屠杀”

Tavares 表示,虽然全球电动汽车需求放缓部分是由于价格高,但汽车的利润已经足够微薄,各车企不应该降价。

“如果你不顾成本降价,这就是一场逐底竞争,最终将导致一场血腥屠杀。这正是我想要避免的。”

Tavares 特别提到了特斯拉。过去一年多里,特斯拉多次降价以刺激需求,在全球掀起了轰轰烈烈的价格战。

以价换量的结果是,特斯拉 2023 年全年交付量同比增长 38% 至 181 万辆,超额完成目标,但公司盈利能力受挫,去年第三季度净利润同比下滑近 44%。

“我知道一家公司残酷地降低了价格,他们的盈利能力也惨遭崩溃,” 他说,“当你这样做时,你就是在跳入红海,当你这样做时,未来的事情会变得非常困难。”

他表示,持续亏损的公司 “成为潜在的整合目标”,并补充说,不排除 Stellantis 未来进一步收购的可能性。

福特最受欢迎产品熄火,称 2024 年全球电车销量增速低于预期

在 Tavares 发表评论之前的几个小时,福特宣布,削减纯电动皮卡 F-150 Lightning 的产量,理由是销量疲软。

作为福特的标志性产品之一,F-150 多年来一直是美国最畅销的皮卡车,以可靠、使用寿命长等特点深受美国车主喜欢。2022 年,福特顺势推出电动版 F-150 Lightning,被视为电动车发展的一个重要时刻。

受成本波动影响,福特去年多次调整 F-150 Lightning 的价格,先涨后降,今年 1 月初又小幅提价。

福特首席执行官 Jim Farley 补充表示,“我们看到针对特定消费者的电动汽车有着光明的未来,” 但福特 “有能力根据客户需求大规模生产燃油和混动 F-150 卡车”。

目前福特还缩减了动力电池工厂的计划,而通用和特斯拉则暂停了部分电动汽车工厂扩建计划。

福特预计,2024 年全球电动汽车销量继续增长,但增速低于预期,理由是消费者不愿意接受比燃油车还贵的替代产品。

欧美电动汽车市场现疲态

去年,英国和欧元区电动汽车的市场份额下降,美国的销量增长放缓,欧美电动汽车销售已初现疲态。

根据数据集团 Cox Automotive 旗下研究公司 Kelley Blue Book 公布的数据,2023 美国电动汽车销量达到创纪录的 120 万辆,电动汽车占国内汽车市场的 7.6%,高于 2022 年的 5.9%。

“虽然创下了记录,但媒体经常报道的经济放缓是真实存在的,” Kelley Blue Book 分析师表示,“美国电动汽车市场仍在增长,但增长速度没有那么快。”

数据显示,美国去年第三季度的汽车销量同比增长 40%,低于 2022 年第四季度的 52%。