US stocks and bonds both plummeted on the first day of the year. What signals are indicating a market reversal?

“大型科技股在 1 月份遭遇暴跌现已成为共识。”“超买状况和乐观情绪将从 2024 年开始(翻转),导致美债收益率和美股收益率出现逆转。”

2024 年首个交易日,美股和美债双双遭遇 “开门黑”,令畅想市场延续 2023 年年底涨势的交易员大失所望。

当地时间周二,对利率敏感的两年期美债收益率盘中升 10 个基点,基准十年期美债收益率一度升近 10 个基点,冲上两周高位,后随着原油期货收窄涨幅并转跌,收益率升幅收窄。

美股三大指数集体低开,纳指一度跌近 2%,标普 500 指数一度跌近 1%,后收窄部分跌幅。最终,三大指数中仅道指勉强收涨。

与此同时,SPDR S&P 500 ETF Trust(SPY)和 iShares 20+ 年期国债 ETF(TLT)携手下挫 0.6%,虽然跌幅不大,但这是自 2002 年 TLT 开始交易以来,它们首次在年初大幅下跌。

美国股债同步回落,表明投资者在追赶去年 Q4 的反弹方面犹豫不决,美股和长债在去年 Q4 的涨幅均超过了 10%。

研究机构 22V Research 创始人 Dennis DeBusschere 表示:

我们从投资者那里听到的最常见的担忧或想法是,超买状况和乐观情绪将从 2024 年开始(翻转),导致美债收益率和美股收益率出现逆转。

很难反驳超买状况和情绪指数。

债券收益率全线收高的背后,是大量企业发行债券令利差承压,而交易员则减少了对美联储今年大幅降息的押注。

有迹象表明,资金可能正在抛弃近期受追捧的股票,流向更便宜的落后股票。周二罗素 1000 增长指数下跌 1.5%,而其价值指数则上涨 0.4%。

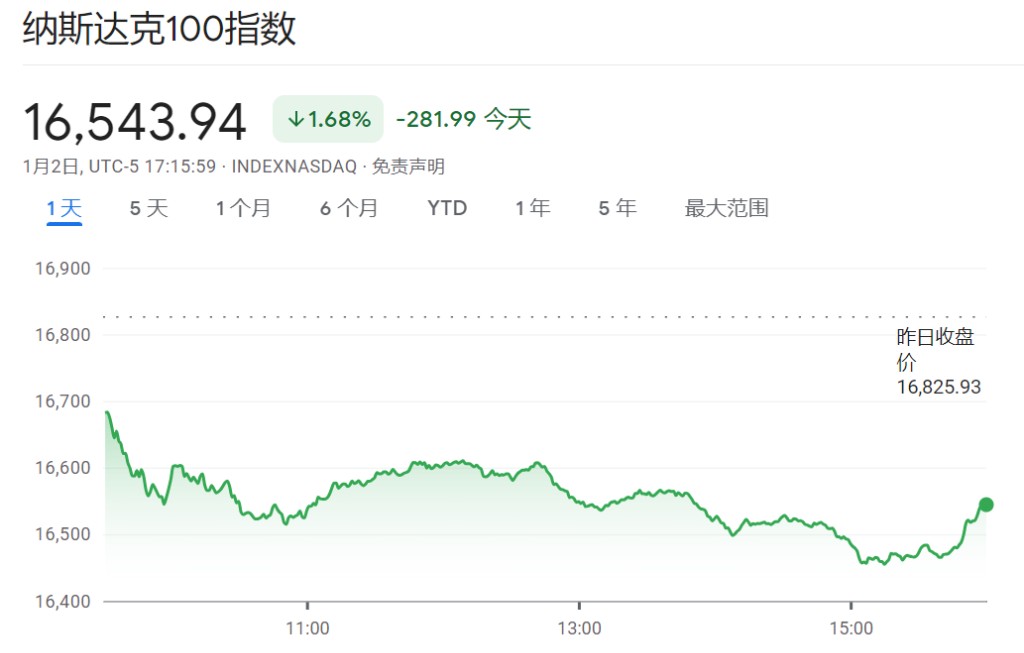

2023 年美股最大赢家之一的科技巨头周二遭遇抛售。纳斯达克 100 指数下跌 1.7%,创下自 2001 年互联网泡沫破灭以来第三糟糕的首个交易日表现。

巴克莱下调评级后苹果一度跌超 4%,领跌科技板块,奈飞、Facebook 母公司 Meta、微软、谷歌母公司 Alphabet 纷纷收跌。

美银 Savita Subramanian 策略师团队在一份报告中写道:

美银 Savita Subramanian 策略师团队在一份报告中写道:

2023 年领先股的拥挤风险,已经被许多人 (包括我们自己) 认为是 2024 年的一个主要风险。

大型科技股在 1 月份遭遇暴跌现已成为共识。

据媒体此前调查,在经历了 2023 年的大涨之后,华尔街策略师认为新一年的股票回报率将大幅下降。来自主要公司的 14 位策略师预计,标普 500 在 2024 年底将达到 4881 点,仅比上周五收盘价 4769.83 点高出约 2.3%。