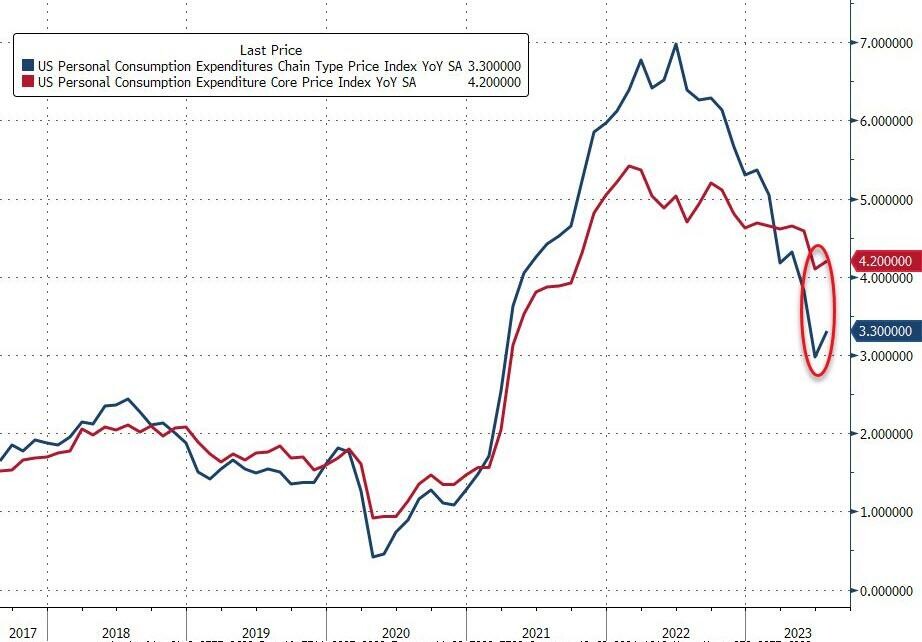

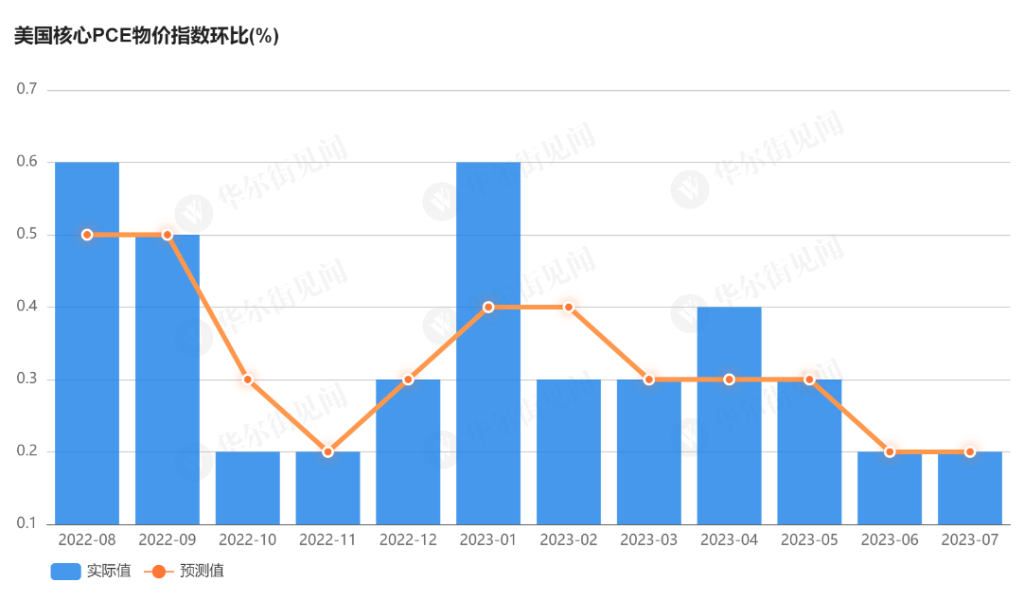

US core PCE price index in July rose 4.2% YoY as expected, with MoM recording the smallest consecutive increase in over two years.

US core PCE price index YoY growth in July slightly increased to 4.2%. Inflation in the service sector remains largely at a high level, combined with unfavorable base effects going forward, indicating that the struggle to reduce inflation may be slow and difficult. Although personal spending has accelerated for the second consecutive month, personal income has slowed down for the second consecutive month, and the personal savings rate has dropped to 3.5%, suggesting that the pace of spending in the near term may not continue in the coming months.

The core PCE price index in the United States for July recorded the smallest consecutive increase in more than two years on a month-on-month basis. Adjusted for inflation, consumer spending further increased by 0.6% on a month-on-month basis. However, real disposable income, which supports consumer spending, decreased by 0.2% on a month-on-month basis, and the personal savings rate dropped to 3.5%, indicating that the pace of spending may not continue in the coming months.

On Thursday, August 31, the latest data from the U.S. Department of Commerce showed that the PCE (Personal Consumption Expenditures) price index in the United States for July rebounded from 3% in June to 3.3% on a year-on-year basis, in line with market expectations, marking the largest year-on-year increase since June 2022. On a month-on-month basis, it increased by 0.2%, in line with expectations and the previous value.

The core PCE price index, which is the Federal Reserve's favorite inflation indicator excluding food and energy, slightly increased from 4.1% in June to 4.2% on a year-on-year basis, in line with market expectations. On a month-on-month basis, it increased by 0.2%, also in line with expectations and the previous value. This is the second consecutive month of a 0.2% month-on-month increase in the core PCE price index, which is in line with the trend of gradually cooling inflation. The reason is that in order to achieve the 2% inflation target, the monthly inflation rate should be 0.2% (0.1% for some months).

It is worth noting that the Federal Reserve's view on inflation in the service sector, excluding housing, is of greater concern. The corresponding PCE price index shows that inflation in the service sector remains largely at a high level.

In July, inflation in the service sector increased by 0.4% on a month-on-month basis, marking the largest month-on-month increase since the beginning of the year, while inflation in goods decreased by 0.3%, marking the largest month-on-month decrease since 2022.

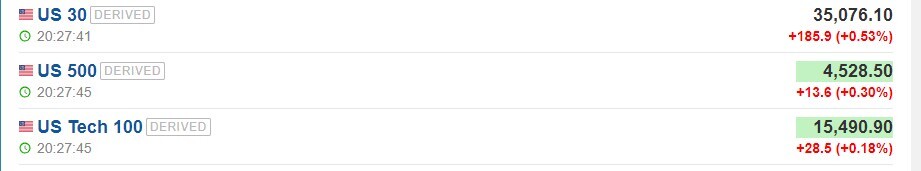

After the data was released, the U.S. dollar index briefly declined by about 10 points and is now reported at 103.41.

U.S. stock futures edged higher, with Dow futures expanding their gains to 0.6%.

Personal spending accelerates for the second consecutive month, while personal income slows for the second consecutive month

In July, personal consumption expenditure (PCE) grew strongly by 0.8% MoM, exceeding the expected 0.7%. The June data was revised upward to 0.6%.

After adjusting for inflation, real personal consumption expenditure continued to grow by 0.6% MoM in July, surpassing the expected 0.5% and marking the strongest increase so far this year.

However, personal income slowed from a 0.3% MoM growth in June to 0.2%, falling below the expected 0.3%. This is consistent with the performance in June, where income fell short of expectations while spending exceeded income.

Wage growth slows down:

Private sector employee wages and salaries YoY decreased from 5.9% to 4.6%.

Government employee wages and salaries YoY decreased from 6.1% to 6.0%.

The decline in real disposable income, which supports consumer spending, was 0.2% MoM, the largest decrease since June 2022.

At the same time, the personal savings rate plummeted from 4.3% to 3.5%, the lowest level since October 2022. Analysts suggest that this indicates that the pace of spending in the near future may not continue in the coming months. In July, U.S. consumer credit has already leveled off.

The struggle to tame inflation may be slow and difficult.

Like the CPI, the PCE price index is also affected by base effects. Under the backdrop of last year's soaring inflation, the recent inflation data has a favorable base.

However, the PCE price index started to decline in late summer 2022, which means that the current base is not so favorable for inflation data.

Last week, at the Jackson Hole Global Central Bank Conference, Federal Reserve Chairman Powell emphasized that inflation is coming down from its high levels but still remains elevated. The Fed is prepared to raise interest rates further at the appropriate time, while also tempering this hawkish assessment with cautious wording, stating that the central bank will "proceed cautiously" when making future rate hike decisions. When considering the next steps, the Federal Reserve will also closely monitor the August non-farm payroll data released on Friday. Economists expect an increase of 168,000 non-farm jobs in August, while the unemployment rate is expected to remain unchanged at 3.5%.