The job market that the Federal Reserve wants is cooling down! US job vacancies unexpectedly plummet to a more than two-year low.

US job openings in July fell more than expected, reaching a two-year low, indicating a more balanced labor market, which will help curb upward pressure on inflation.

The report from the US Department of Labor on Tuesday showed that job vacancies in the US fell more than expected in July, reaching a two-year low. This indicates that the labor market is becoming more balanced, which will help curb upward pressure on inflation.

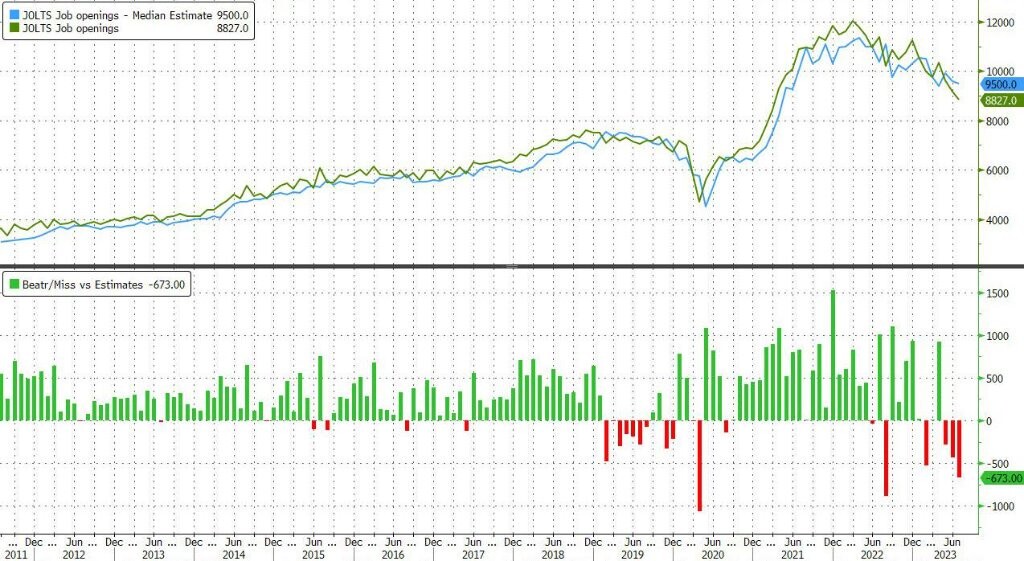

In terms of specific data, "In July, job openings in the US JOLTS survey stood at 8.827 million, falling below the 9 million mark for the first time since March 2021, significantly lower than the unexpected 9.45 million in June, and a substantial downward revision from the previous value of 9.17 million."

In the past seven months, job vacancies in the JOLTS survey have declined for six months. In February of this year, the number of job vacancies fell below the 10 million mark for the first time since 2021, and this downward trend continued in March, with both months' data significantly lower than expected. For over two years prior to February, JOLTS data was quite strong and exceeded expectations most of the time.

The decline in the number of job vacancies is mainly seen in the following industries: professional and business services (decreased by 198,000), healthcare and social assistance (decreased by 130,000), state and local government excluding education (decreased by 67,000), state and local government education (decreased by 62,000), and federal government (decreased by 27,000). In contrast, job vacancies increased in the information sector (increased by 101,000) and transportation, warehousing, and utilities sector (increased by 75,000), among others.

In July, there were 1.5 job vacancies per unemployed worker, the lowest level since September 2021. In March of last year, this ratio reached a record level of over 2. The ratio was 1.2 before the COVID-19 pandemic and is still significantly higher than the long-term trend.

"The number of voluntary quits in July decreased by 253,000 to approximately 3.549 million, reaching a new low since February 2021, and the voluntary quit rate dropped to 2.3%, the lowest level since early 2021." A higher voluntary quit rate indicates a tight labor market, where workers have the confidence to leave their current jobs in search of better opportunities, and vice versa.

The number of hires decreased by 167,000 to 5.773 million, reaching the lowest level since January 2021. The number of hires has decreased by 458,000 in the past two months, the largest decline since the end of 2020.

"Layoffs and discharges remained virtually unchanged. Given the persistent labor shortage and the resilience of US consumers, companies are still reluctant to lay off employees."

Analysis suggests that the decrease in job vacancies, coupled with an increase in labor force participation, is making the US labor market more balanced and helping to curb wage growth. Despite the current easing of demand for workers, the unemployment rate remains historically low. Despite the Federal Reserve's aggressive interest rate hikes, the labor market trend leads people to believe that the US can avoid an expected economic hard landing. Federal Reserve Chairman Powell stated last week that if the labor market continues to slow down, inflation may continue to decline. After the release of the JOLTS data, the yield on the US 10-year Treasury bonds fell, with a short-term dive of about 5 basis points, hitting a daily low of 4.1510% and a daily decline of over 5.1 basis points. The yield on the US 2-year Treasury bonds dropped nearly 9 basis points in the short term, hitting a daily low of 4.9191% and a daily decline of about 13 basis points. US stocks rebounded significantly, with the Nasdaq 100 rising over 1.4% during intraday trading.

The JOLTS report is one of the labor market indicators that former US Federal Reserve Chair Janet Yellen valued the most. It is also a labor market data that the Federal Reserve pays close attention to. The latest data aligns with the Federal Reserve's wishes: labor demand is slowing down. The previously record-breaking job vacancies have been an important driving force behind the Federal Reserve's continued hawkish interest rate hikes.

However, it should be noted that some economists have questioned the reliability of the JOLTS statistical data recently, as the response rate to the survey is very low. As of the end of last year, the response rate had dropped to around 31%, about half of what it was three years ago.

JOLTS data usually lags behind non-farm payroll data by one month. This Friday, the US will release the highly anticipated non-farm payroll report for August. Market expectations are that the US added approximately 170,000 non-farm jobs in August. If this is the case, the data will highlight a slowdown in hiring over the past year.